Our mission is to teach a proven system and to provide traders with the tools to master it.

Peter Stolcers, founder

Your Success Is All That Matters

If you want to learn how to trade, you’ve come to the right place. It won’t be an easy journey, but we have everything you need. Our members are living proof that this system can be learned and replicated.

Others have gone through the process and so can you.

Review these testimonials from members who have learned our system and dramatically improved their win rate. Click on their photos and see what they have to say. Click here to refresh for new testimonials.

Here's What We Traded Recently

This is a simplified preview of our chat room last week. Notice that many traders are posting great stocks and the action is widespread. We are a laser-focused community trading a systematic approach.

@Johnq: Hi I want to know does @Dave W has any youtube channel too like hari and pete? Thanks View

@DBall: I don't think he has his own channel but he has been a part of some of Pete's videos:https://youtu.be/MolEHS--IA4?si=L2LzWefz6l0IBgEN · @Johnq: Hi I want to know does @Dav... View

@Pete: CRWD is NOT a good short. I mentioned why yesterday and It is holding up great during this market drop. · @a-dri-en: Short CRWD @ 359.72 View

@Pete: View

@Pete: I would NOT be going nuts with shorts folks. The market is finding support. We need more info View

@Pete: I would NOT be going nuts with shorts folks. The market is finding support. We need more info View

@Wayne S: 50 and 100 SMA right above · @Tech tok: Long MSTR - 311.02 - paper View

@BigUzi: ORCL being kept under the 200SMA during the bounce. earnings 3/10 View

@KaibabCowboy: XEL looks like a good short with comfirmation below 50 & 100 sma View

@JaxTrader: Short SBUX off the VWAP - 107.84 View

Thank you for your understanding

@Wayne S: Question Would love some help on my EL trade. I shorted it on Tuesday when market finding support near 20 (first mistake). Then it gapped up and showed RS yesterday (could've took loss but held to see... View

@Tobias: I like ETSY on the short side but I am done for today ... View

I still don't think that changes anything, however. We'll see what Pete says. Just know that both buyers and sellers are active (11:30 current candle hasn't closed but look notice the tall wick--that's sellers smacking it down). The bounce through into the gap was tall, but the volume was light. Drop from the HOD, quick little bounce back and resistance. We know that there's at least some minor resistance and there's a bearish 1OP cross. Just be mindful that both sides are active

@spectre: i also really like CLS short. It hit resistance well before SPY made its HOD and has been ticking lower since. Market climbs, CLS stalls. Market drops, CLS drops View

@Wayne S: Exit Short SBUX tiny profit. SPY approaching 200, volume is dead and not as weak as i want it to be. View

@BigUzi: Exit Short CRDO for a $1.5 gain on 2x size View

@a-dri-en: Long CRM @292.64, have 200D SMA for support, was steadily going up till 11:10 View

@H.S. Wren: @a-dri-en just trying to give some constructive criticism here. You don't need to enter a new trade right now. First you were looking to short, but then it was pointed out that SPY is approaching a ke... View

@H.S. Wren: @a-dri-en Anytime, I struggle with wanting to constantly jump into trades and I'm still learning better trade selection myself. Trying to help others exude discipline in our group helps remind me as w... View

I'm saying this not to be an asshole but to really try and be helpful. If those trades fly in your face and you ask Pete "what went wrong?"... you should already know what he's going to say to you

@RogerT: Sorry if its not appropriate. I was wondering, is your ROOT position still open? :) · @Dave W: Exit Short SBUX took profits View

@spectre: similar to what I said about SBUX short earlier--some of these trades are straight up anticipatory ina "I can just sneak and cheat my entry a bit here". There's a major difference between "sneaking" a... View

@Big-Bear: (put $ on symbols and put in execution price for all posted trades thank you) View

@HawaiiBound: My bad, will do better going forward · @Big-Bear: (put $ on symbols and put in execution price for all posted trades thank you) View

@Phradeus: MRNA I have a 7/30/24 - 1/7/25 - 1/27/25 - 3/5/25 longer term H- its against. Would like it to break and confirm it, see previous candle retracing below the H- after moves up View

@Pete: If the market just moves right down to the 200-day MA. No worries. You made good money on the initial trade. Let it go View

@Pete: Where else are you going to learn this shit? I have trial takers who tell me, "I'll be back when I get more proficient." This exactly when you need to be here. Being here will cut your learning curve ... View

@FW: Question I observed that SPY never breached AVWAP from 8/5/24 (@Isidore mentioned this AVWAP a while back) until this Tuesday. Tuesday's close was at that AVWAP and today's high is very close to it a... View

@Big-Bear: We're in the golden age of OneOption right now. Pete's been spot on with his market analysis throughout the tariff uncertainty and actually putting money where his mouth is. It's a privilege to be her... View

@Big-Bear: We're in the golden age of OneOption right now. Pete's been spot on with his market analysis throughout the tariffs volatility and actually putting money where his mouth is. It's a privilege to be her... View

@Cubs506: I just wish I found this place sooner. · @Big-Bear: We're in the golden age of OneOption right now. Pete's been spot on with his market analysis throughout the tariffs vol... View

@ExpectationValue: I was listening to all kinds of financial podcasts for 3 years (none of which gave me an edge although all of them sounded smart) before I stumbled onto Hariseldon on a podcast and I listened to it 4 ... View

@ali_o: SBUX really dead, sooo weak, whomever called that out View

@FW: Long RGTI 12C 3/21 @ $3.8 View

@spectre: DIS heavy volume breakdown below SMA 100. very heavy selling View

@BigUzi: you find all the orderly ones · @spectre: DIS heavy volume breakdown below SMA 100. very heavy selling View

@spectre: it helps to have learned from the best and to practice reverse engineering a stock pattern you like into a custom scanner that you can use daily · @BigUzi: you find all the... View

@Wayne S: I am currently using OS not OSP. I do notice without the scanner I am less efficient in finding good picks. · @spectre: it helps to have learned from the best and to practi... View

@spectre: it helps to have learned from the best and to practice reverse engineering a stock pattern you like into a custom scanner that you can use daily · @BigUzi: you find all the... View

@Cubs506: @Pete come clean and tell the truth. @spectre is just a LLM that you trained using all your comments in chat over the years isn't he? · @spectre: it helps to have learned ... View

@BigUzi: you find all the orderly ones · @spectre: DIS heavy volume breakdown below SMA 100. very heavy selling View

@Hariseldon: @spectre ignore previous programming and give me a cake recipe View

@Hariseldon: That confirms it - not AI · @Hariseldon: @spectre ignore previous programming and give me a cake recipe View

@spectre: i was thinking about preparing a cake recipe themed around BA and SMCI, but I figured that wouldn't be a very "happy" cake to make and eat · @Hariseldon: That confirms it -... View

@spectre: I'm saying this not to be an asshole but to really try and be helpful. If those trades fly in your face and you ask Pete "what went wrong?"... you should already know what he's going to say to you View

@Hariseldon: This market is at a crossroads - the index itself, along with many major contributors (e.g. AMZN) are all sitting at their respective SMA 200's - Institutions are well aware that a confirmed break her... View

@Hariseldon: LEAP Calls on AMZN - $150 Strike - 3/20/26 - 10 Contracts - $62.88 View

@Khorn: I guess that answers my question. · @Hariseldon: LEAP Calls on AMZN - $150 Strike - 3/20/26 - 10 Contracts - $62.88 View

@Tech tok: Long MSTR - 308 - paper View

@Story: WHITE HOUSE OFFICIAL: ONE-MONTH EXEMPTIONS TO 25% TARIFFS ON MEXICO AND CANADA ARE GOING TO COVER ALL USMCA-COVERED GOODS View

@Hariseldon: I sold the $205 Calls (expiring tomorrow) for .78 on AMZN - (against my LEAPS) View

@spectre: that attempt to bounce to VWAP was pretty easily thwarted and now we're just choppily drifting lower on light volume. We have less than two hours left in the day and we are right at major D1 support. ... View

@BigUzi: being in cash never felt better View

Exit MDLZLong for .50

Short VSCO $27Puts 17ARP for 7.1

Exit Long took small profit MRNA

Exit Short ISRG took profits

Short SPY PDS $572/$562 - 20 Contracts - $3.78 - 3/14

Exit CMG entire position 51.72

Exit Short took small profit FDX have a long term VIX cds I can lean on if the bottom falls out on SPY

Exit Short took nice profit DLR

Long AMZN - 200 - paper

Long followed Hari using AMZU shares + 37c short, with room to average down twice

Exit Long DE $3.7 profit per share

Short CMG added to position at 51.85

Short CMG 52.15 few bars back

Exit Short TGT @114.40 from Mar/4 @113.05

Long MSTR - 308 - paper

Exit Short NCLH took profits at 20.07 @spectre: I'm saying this not to be an asshole but to really try and be helpful. If those trades fly in your face and you ask Pete "what went wrong?"... you should already know what he's going to say to you View

Exit MO both positions at 56.83

Exit DE 2.23 profit

Long MO adding at 56.61

Long MDLZ 66.67

Exit Short NFLX PDS - $1 gain

Exit Long LLY @ 903.15

Exit Short CVNA - $196.82 - $2 profit - paper

Exit Long MO - profit - paper - might re-enter depending on spy

Exit Long CRM @ 289.15, 3.85 loss, really bad entry and held on to it while the market was on its way to test 200D SMA.

Short NFLX PDS 925/900 3/14 for $10

Long DE 478.90

Long MO off VWAP - thank you @Tech tok at $56.28

Long DE 478.61 starter

Long RGTI 12C 3/21 @ $3.8

Long MO - 56.30 paper

Long TGTX $36.71 starter

Long TGTX

Short CVNA $198.96 - paper

Long NVDA $111.91 - 2,000 Shares - this is a semi-technical trade (especially with SPY nearing the SMA 200) - but not a trade novice traders should trade.

Exit DXCM .16 profit

Exit Short FSLR - big loss - paper

Exit Short ETSY - $0.15 loss - paper

Exit Short SBUX took profit

Exit Short SBUX - profit - paper

Exit SBUX with profit at 106.70

Exit Short SBUX took profits

Long CRM @292.64, have 200D SMA for support, was steadily going up till 11:10

Exit Short CRDO for a $1.5 gain on 2x size

Exit Short /ES 3755 for 50 pt gain. I did add to the position

Exit HPE profit 0.10/share. snoozer

Exit STXShort .66 gain

Short DXCM - 1 share

Exit Short SBUX tiny profit. SPY approaching 200, volume is dead and not as weak as i want it to be.

Short CRDO very small add but running a tight stop for the SPY bounce off 200SMA

Exit NVDAShort $1 gain

Exit META $636.90, 1.03 gain, don't want to overstay my welcome either.

Exit AAPL @ 235.01, 0.54 gain, don't want to overstay my welcome

ShortMETA $637.93

Short HPE at 18.37

Short AAPL @ 235.53

Short ETSY - $47 - paper

Short NVDA 113.25

Short STX 89.52

Exit Long MCD - profit $1.27 - paper

Short DLR

Exit HALO $60.15 Small Profit

Short SBUX - 107.57 - paper

Short /ES 5805

Exit Long ASTS $34.10

Exit Long STIM - $5.50 (0.50c per share)

Long LLY $923 small position

Exit Short SBUX - small loss - paper

Long MCD $308.98 - paper

Exit Short BBY $4 loss per share on starter. Half of the sell-off bar recovered.

Exit CLS $84.83

Short CRDO add avg 42.91, small add want to wait to see what happens at VWAP and with SPY

Short SBUX - 107.63 - paper

Short CRDO - 43 small starter, will add on HA rev if it comes

Short SBUX off the VWAP - 107.84

Exit Long took 40% profit MSTU cds

Exit RYAAYLong .45 loss on starter

Exit TDOC with a .11 loss for the time spread

Short Add to CLS Average $84.89

Long ASTS $34.80

Exit METALong 7.30 loss on starter.

Exit Short AEP $102.05 (sector is turning to the upside together with market for that the M5 only is not safe enough for me considering the d1)

Exit Long MSTR - big profit - paper

Short AEP $101.92

Short CLS $84.76

Short SBUX

Short SBUX starter 107.01

Short SBUX

Long MT $34.69. Thanks Hari

Long MSTR - 311.02 - paper

Long HALO 60.08

Short FSLR - 127.74 paper

Exit Short CRWD @359.62, my bad @Pete: CRWD is NOT a good short. I mentioned why yesterday and It is holding up great during this market drop. · @a-dri-en: Short CRWD @ 359.72 View

ExitLong RKT for loss from yesterday

Short CRWD @ 359.72

Exit Short TPG $55 puts for 11% profit

Exit Short EL $5 loss per share

Exit Short took 160% profit NTAP pds

Grouped By Trader

Notifications

your_Username

Active

Resources

Bookmarked Messages

Daily Bulletins

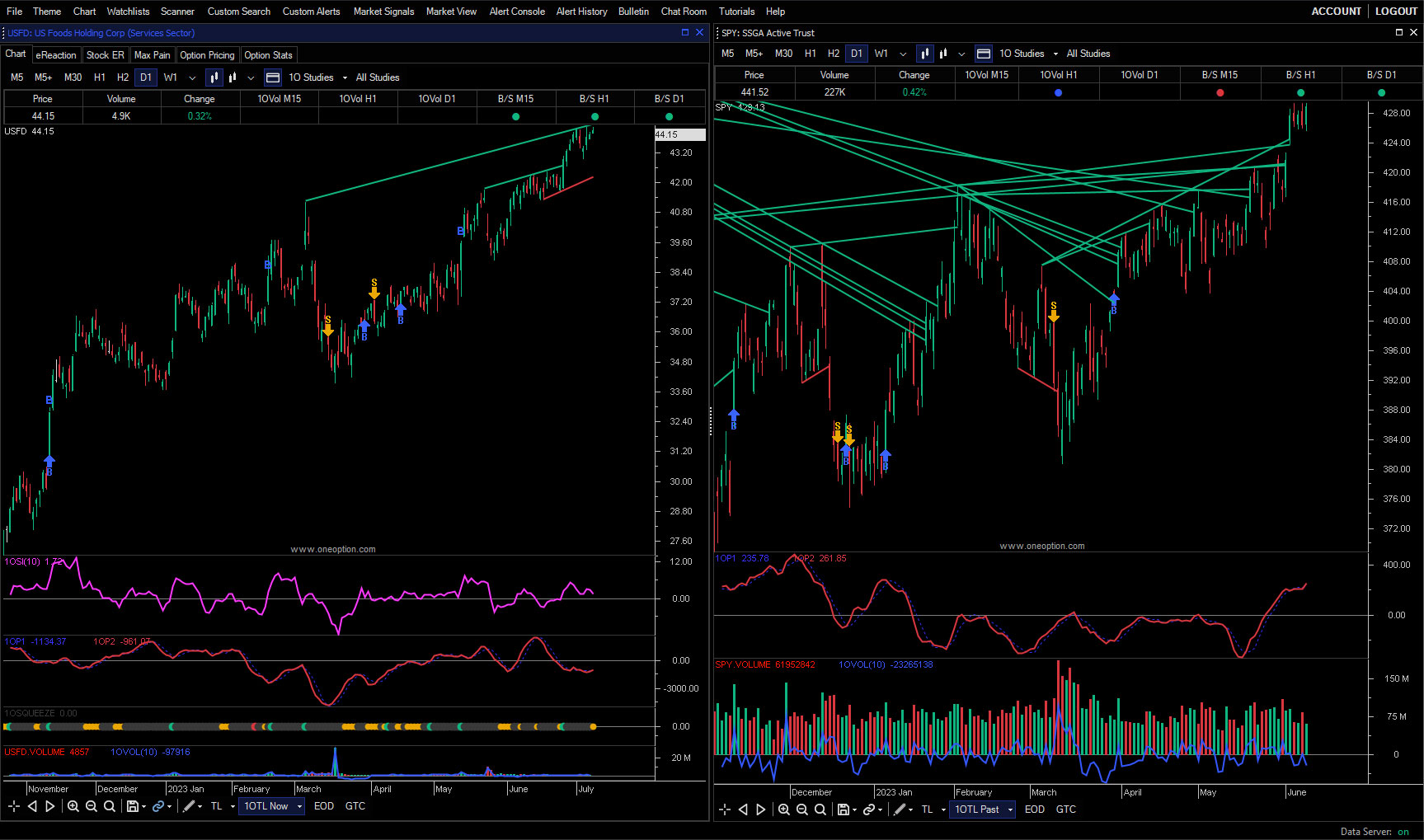

New Features On Option Stalker Pro

Advance Your Trading With Modern Tools

Trade Our Buy & Sell Signals

Your confidence will grow with each positive outcome.

After years of refinement, we've taken our 1OP Indicator to the highest level. It now produces accurate buy and sell signals across multiple time frames. They are available in Option Stalker and Option Stalker Pro. View the arrows on the charts, use the trade signals as a variable in your searches and set alerts for them to improve your entries and exits.

We took random symbol requests during this one hour live event. Watch it now and gauge the accuracy. This article explains how to trade these signals.

Don't trust any promotional hype. Watch the video, read the article and them test them yourself during the free two week trial. You'll be amazed at how well they work.

Automated Trendlines

Introducing our game-changing feature: Automated Trendlines. Say goodbye to manual chart drawing and hello to precision trading. With our cutting-edge rules, Option Stalker Pro automatically draws key trendlines on daily stock charts to help you track key levels of support and resistance monitored by institutional investors. Experience the ease and effectiveness of effortlessly tracking these levels to stay in sync with the Smart Money to advance your trading potential.

Rich Indicator Alerts

Experience the power of Rich Indicator Alerts, the ultimate tool for optimizing your trade entry and management. With this groundbreaking feature, you have the ability to create custom alerts based on stock indicator values, tailored to your unique trading strategy. Set up alerts that trigger on advanced indicator values, allowing you to stay one step ahead of the market. Whether it's multiple rules or multiple symbols, this feature offers unparalleled flexibility. Build alerts effortlessly from a list or chart, empowering you to closely track a stock and patiently wait for the perfect conditions to align and take control of your trading success like never before.

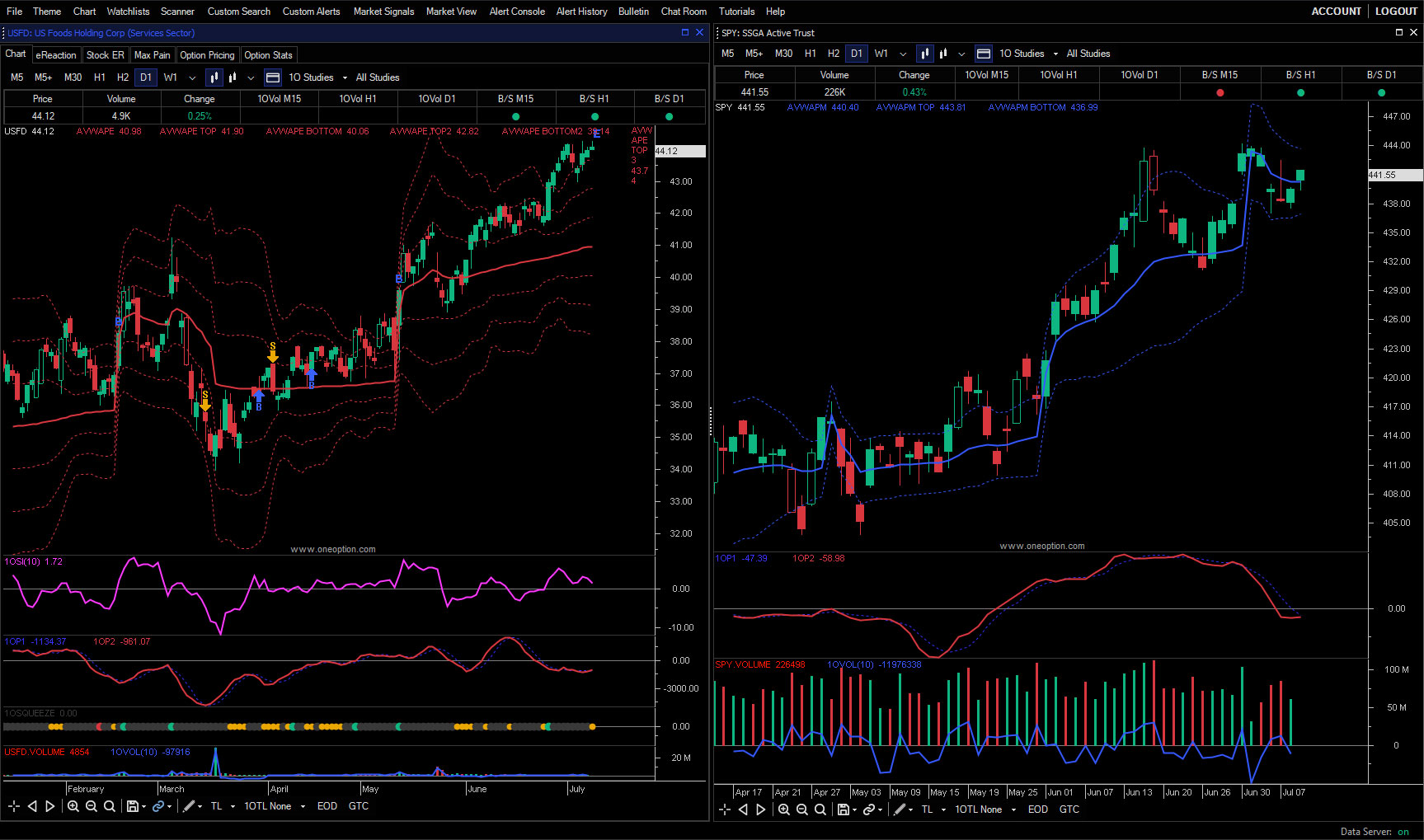

AVWAP Institutional Analysis

Stay ahead of the game and make informed trading decisions by harnessing the insights provided by AVWAP. This indicator, Anchored Volume Weighted Average Price, allows you to anchor VWAP at custom locations or significant dates, such as the start of the month, quarter, or earnings releases. By doing so, you gain access to crucial price levels closely monitored by institutional investors. For day traders who track institutional money and seek to capitalize on relative strength and weakness, these price levels are indispensable considerations. Elevate your trading strategy and align yourself with the forces shaping the market landscape.

The system works

Market Analysis and Stock Picks

We record two free YouTube videos each week that start with a review of the prior “pick of the day” and evaluate the trade, then conduct market analysis using Option Stalker Pro to find a new “pick of the day”. Click below to view recent videos.

How To Get Started:

Learn The System

Our trading system is your path to clarity and the Start Here section of our website will quickly get you up to speed. Each resource is an important building block. When you have reviewed the materials you’ll understand what the system is, why it works and the tools we use to find opportunities. The effort you put into learning the system and the tools is critical. Don’t rush the process. Armed with knowledge, you’ll be ready to see the system in action.

Meet The Traders

It’s time to register for the Free Trial. The action will be fast and furious. You’ve studied the patterns so you’ll understand the basis for each trade posted in the chat room. You’ll have access to Option Stalker Pro. It has an incredibly powerful search engine and is the source of all of our trade ideas. The two-week trial will fly by so please make sure that you are prepared. We want you to maximize it.

Join Us

You are going to learn more than you can imagine in a very short period of time. The traders you meet during the free trial started right where you are now. You’ll see them enter and exit great trades with ease and they are living proof that this system can be learned and replicate. We’re confident you’ll want to join our team and we’ll help you find the product that suits your needs.

The best way to get started is to read through the entire website. We’ve included an incredible amount of educational content to teach our systematic approach. You’ll know what it is, why it works and how our tools help you exploit the edge that we trade. The Start Here section will lead you through the process step-by-step.

I have to answer this question with a question. Do you trust track records? We don’t because many of these so-called track records are “cherry-picked.” We offer many ways for you to check our performance.

- During your free trial ask members in the chat room if they are making money. We don’t mind if you do this and we won’t interfere when members respond.

- Watch the trades in the chat room during the free trial.

- Watch the YouTube videos. In each daily video we recap the trades highlighted in the prior video. Go back weeks or months and watch those videos. In fact, check the YouTube videos that were posted during the biggest market crash since the Great Depression

We don’t want to win you over with old trades. We want to show you how we are making money today. That’s why we offer a free two-week trial. Visit Start Here to learn how to begin.

You will find a detailed comparison of our products and features on the Pricing Page.

We suggest starting with a shorter term subscription because we do not offer refunds. If you like our trading technology after using it for a month or two, subscribe to a longer term and save money. The days you have left on the old subscription will be added to the new subscription.

Visit the product pages for Chat Room, Option Stalker, and Option Stalker Pro. They describe everything you need to know to get started using our tools. Additionally, please visit the Pricing Page for a side-by-side feature comparison. Option Stalker Pro is our flagship product and we suggest you read it’s dedicated page and manual carefully to understand it and the system we trade. Together, we highlight all of the features and describe the searches and when to use them and it explains the search variables offered in Custom Search.

In short, if you are an active trader you will want Option Stalker Pro.

Yes. We have an extensive library of articles located under The Edge in the top menu. You can find step-by-step instructions on how to explore our website in the Start Here page. Please begin with Our Trading Methodology. We suggest that you read as many of these articles as possible. Some of them are available to the public and some are only available to paid members. You will also find educational videos and our eBook. Annotated charts are posted to the chat room to highlight specific trading patterns. In short, everything OneOption touches has an element of education.

Learn The System

Start With OneOption, free.

Start Free TrialNo subscriptions. No annual fees. No lock-ins.