Options Last

Author

PeteThis article is part of our Introductory Series. Visit Start Here to learn more.

Everyone wants to dive right into options trading. They learn a few strategies and they read a few stock headlines and they feel they have everything they need to make a fortune. Getting the market right is 65% of the trading puzzle. Getting the stock right is 30% of the trading puzzle. Options are only 5% of the puzzle and until you have your win rate consistently above 75%, you should not trade options. In fact, you should only trade one share of stock. You need to keep your “tuition” low while you are learning and there will be mistakes. Let’s focus on how we can improve your win rate.

Searches

The best stock candidates have common characteristics. A stock with many desirable characteristics has a higher probability of performing as expected. We refer to those as checkboxes. In addition to our market analysis and proprietary indicators, we offer an incredibly powerful search engine called Option Stalker and Option Stalker Pro. In both products, you can use our favorite searches or you can create your own.

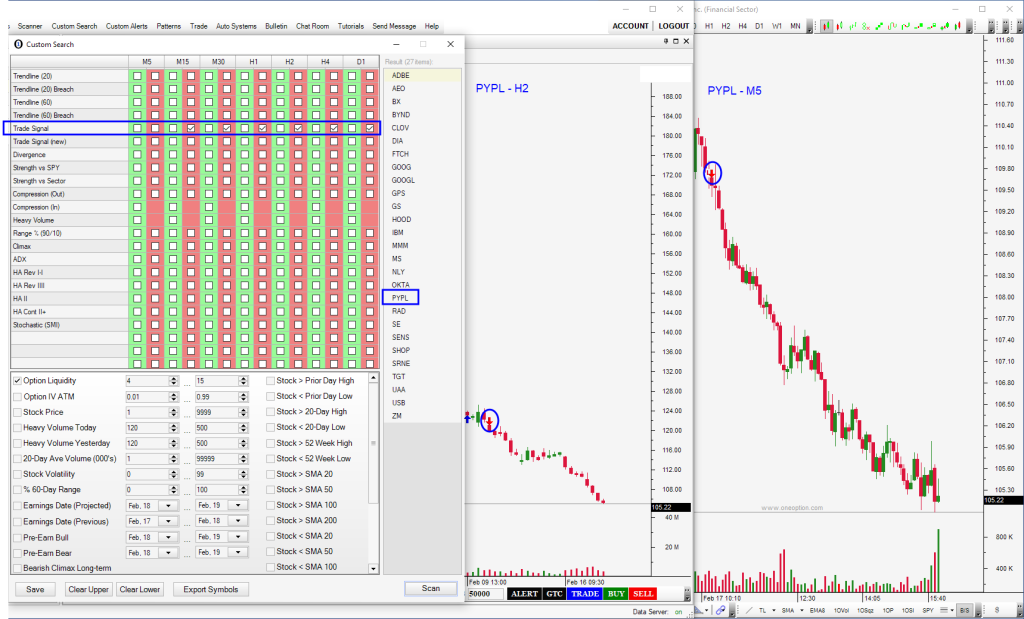

Imagine finding a stock with good option liquidity that had sell signals across all time frames. That would be a weak stock and we can search for them using the Custom Search in Option Stalker Pro. Here’s an example.

Trendlines, trade signals, new trade signals, divergences, relative strength, sector strength, compressions, heavy volume, relative strength, reversals, continuations, liquid options, and earnings dates are just some of the variables you can use in your searches. Name, define (bullish/bearish) and save your searches. No coding is required. Trading opportunities pass quickly and these searches get you right into the action.

Probability

The notion of checkboxes was mentioned earlier. The more checkboxes we mark, the higher our probability of success.

The most important checkbox is the market. Instead of a single SPY M5 sell signal, what if we have sell signals across multiple time frames? That would certainly confirm a weak market.

The second most important check box is the stock. In the stock example above PYPL was on sell signals across multiple time frames.

Now we have a weak market with sell signals across multiple time frames and we have a weak stock with sell signals across multiple time frames. Our probability of success is very high. What if we filtered that list of stocks even further and we looked for stocks with heavy volume, great options liquidity, technical breakdowns and strong momentum?

You get your win rate above 75% by waiting for these high probability set-ups and this is how we help you find them. Once you start consistently nailing trades you can consider options trading.