The Fastest Way To Find The Best Stocks

Option Stalker Pro is our most powerful product designed to trade the S&P 500 and stocks with relative strength & weakness

For Real Time Data, Option Stalker Pro works with these brokers

Do More With A Platform Specifically Built For A Trading System

We discovered a powerful trading edge many years ago that worked beautifully. That’s all we wanted to trade. No one was collecting the data we needed to find these stocks, so we built our own search engine within Option Stalker Pro. Its Custom Scanner matrix is incredibly easy to use and you won’t find these search variables anywhere else. Continue reading to learn how to use it to trade!

Nail The Market

If you get the market right, your odds of success increase dramatically. Our market opinion and our confidence in it drive all of our trading decisions. We trade S&P 500 futures, but we primarily trade stocks with relative strength because of the edge. Here’s how our members use Pro to stay on the right side of the action.

Get Your Bearings

Each morning before the open we post our market forecast in Option Stalker Pro. This is your road map! We discuss the fundamental and technical factors that are having the greatest market impact. Our swing section provides our longer term market bias and our confidence in it. This forecast should drive your swing trading decisions. The day trading section puts the overnight move into context. We describe the likely trading scenarios and we highlight the most promising ones. This will help you plan your trading day. View example report

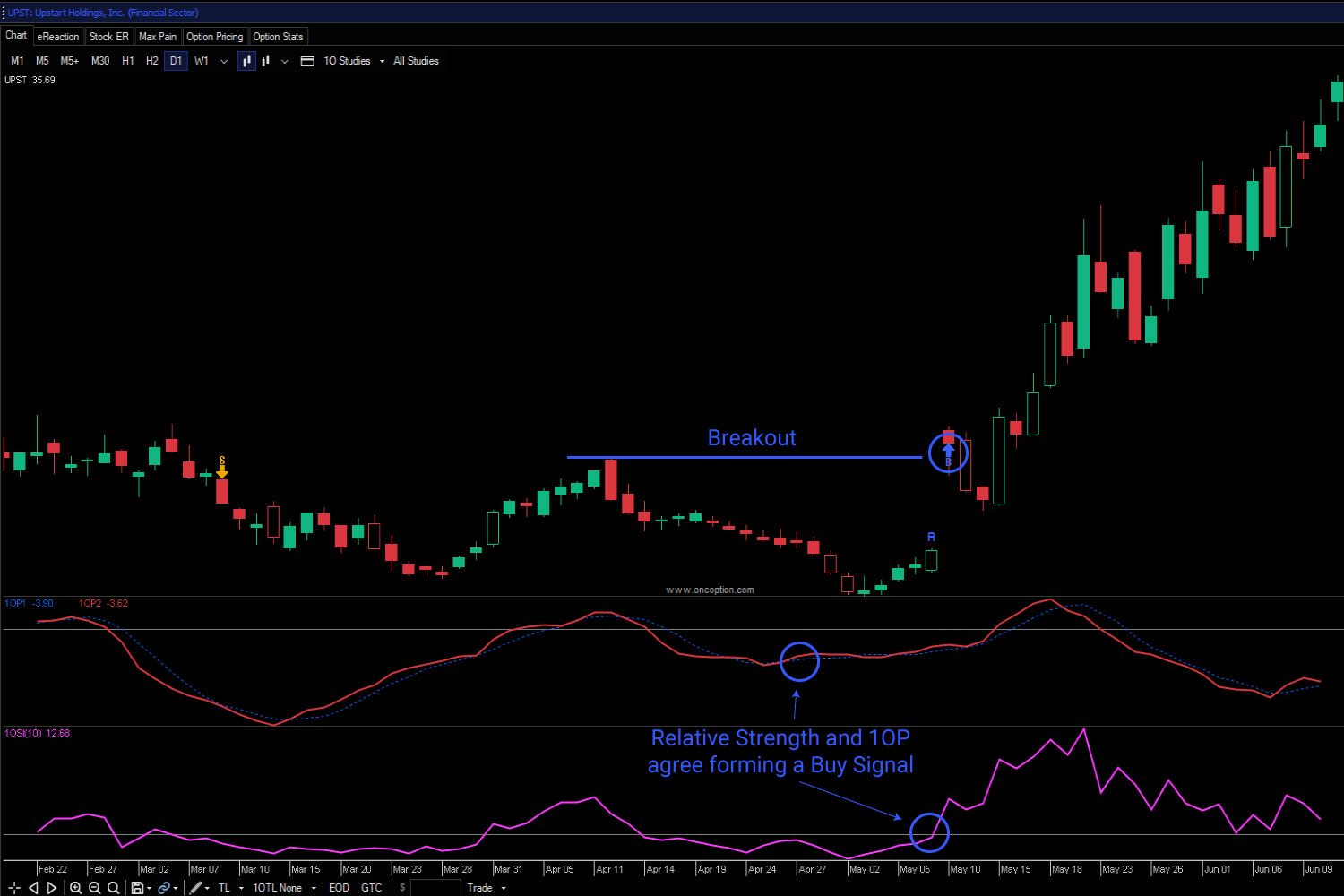

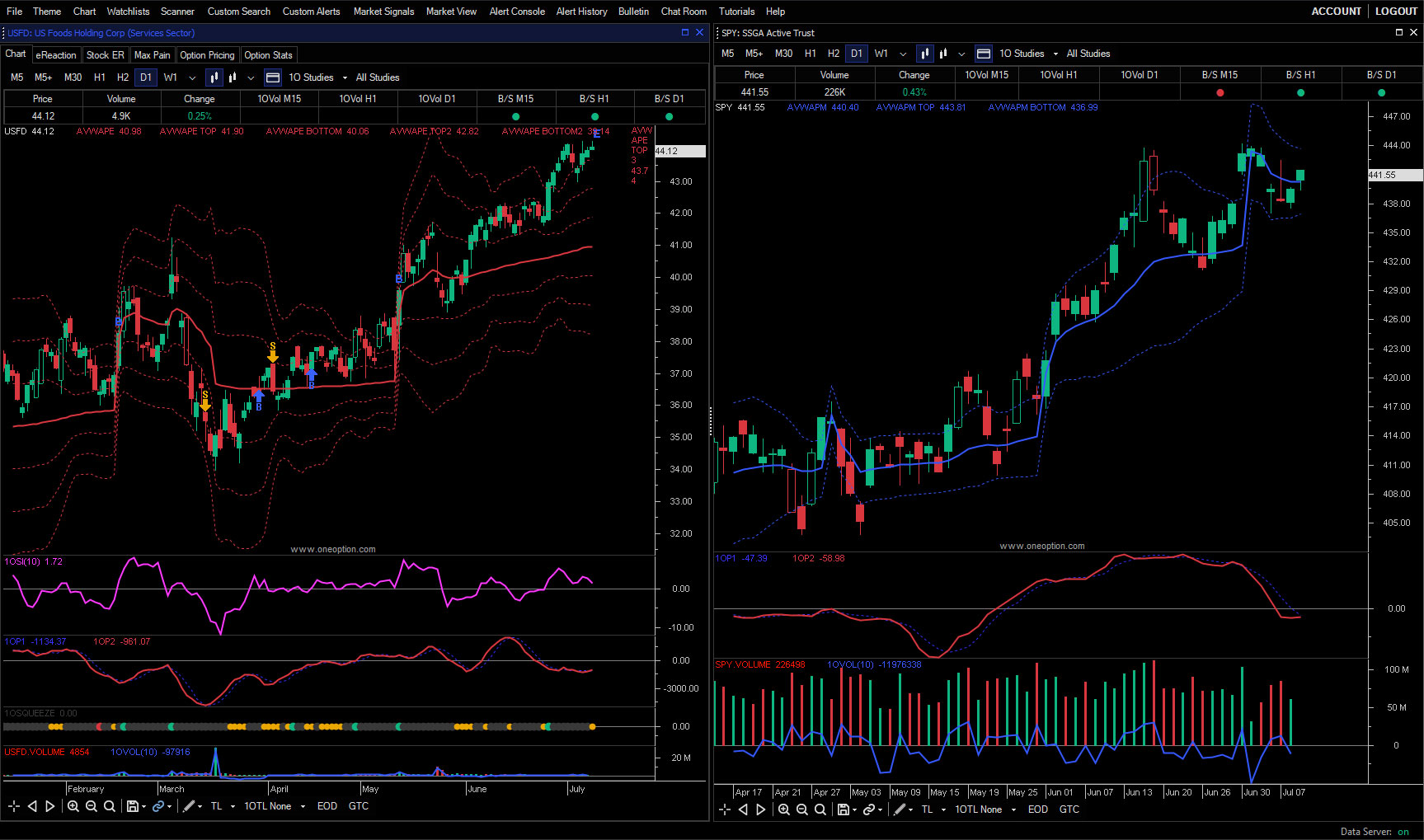

The 1OP Indicator

The 1OP indicator was developed to day trade the S&P 500, but it has many uses. When the trigger line crosses down after a big spike, it signals a potential market drop. When the trigger line crosses up after a deep trough, we can expect a market bounce. When we have price confirmation (trendline breach, horizontal breakout or a reversal pattern) we trade S&P 500 futures. 1OP works on longer time frames and it works for stocks. It is predictive, not reactive. Learn more about the 1OP indicator and how to use it to trade S&P 500 futures.

Timing with 1OP

When 1OP has a cross, a new cycle begins. The magnitude and the duration of the cycle help us gauge market strength. These cycles also help us determine when we should enter a stock trade and when we should exit. Members keep a 5-minute chart of the SPY up at all times so that the 1OP indicator is always in view. When 1OP spikes we take gains on our long stock positions. When it crosses down, wait for the bearish cycle to run before buying a stock. The market will typically retrace during the bearish cycle and that will allow us to gauge the stock’s relative strength. If the stock remains strong, we will buy it on the next 1OP bullish cross for the SPY. Now we have a strong stock and a market tailwind to fuel the move.

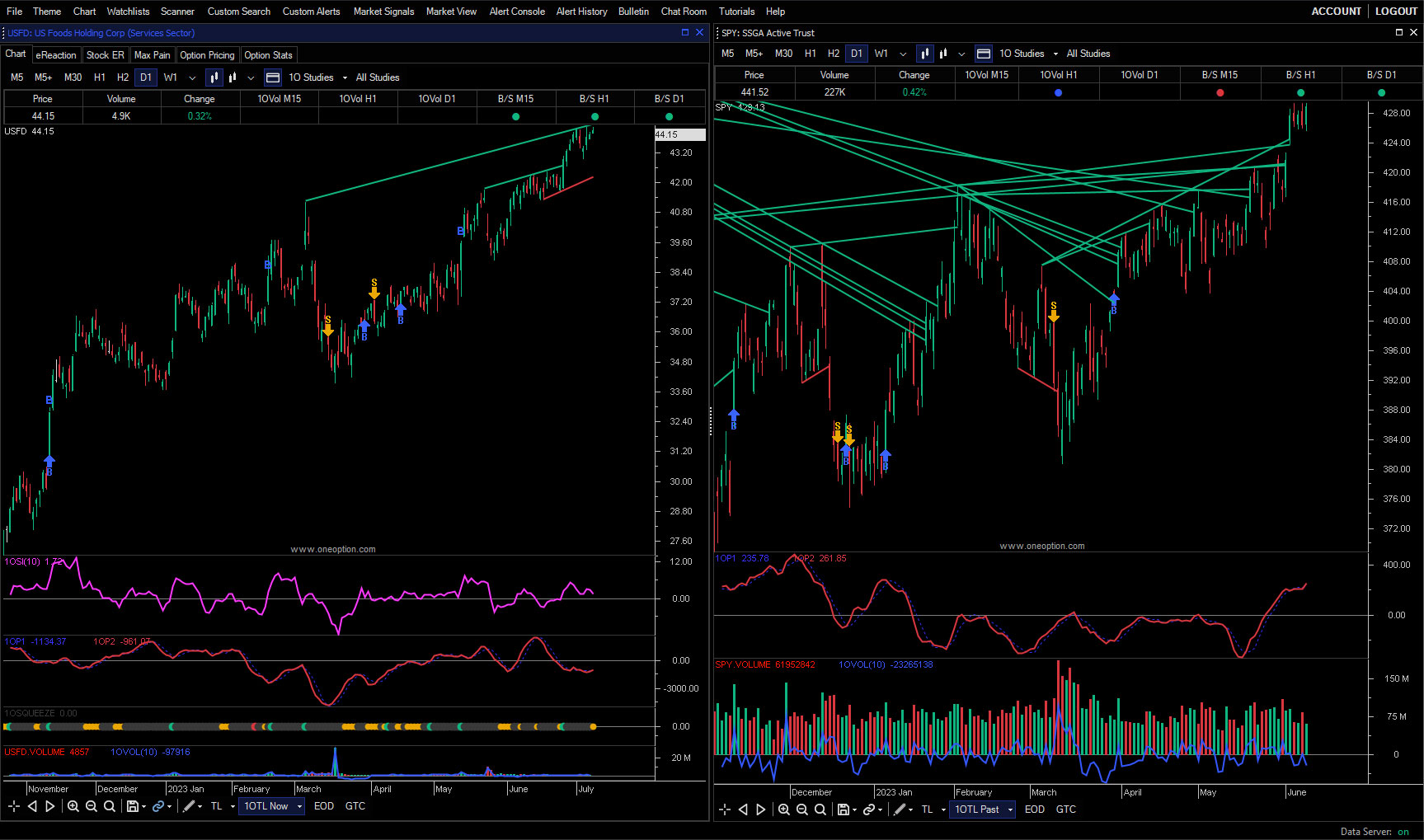

Trading 1OP Signals

1OP trade signals for the SPY that agree across longer time frames (D1, H2, H1) are very reliable. If these signals also agree with our market forecast, swing traders can start searching for stocks. Remember, the market is the biggest piece of the trading puzzle and it is critical to get it right. Day traders can look for 1OP confirmation across shorter time frames (5-minutes, 15-minutes and 30 minutes). If we have buy signals across all of those time frames, you should focus on bullish stock searches for day trading. Once you have your market bias, it’s time to find the best stocks.

Trade Relative Strength & Weakness

Our market signals and our market forecast are reliable, but not infallible. Instead of trading the S&P 500 we use that market bias and we dramatically increase our odds of success by trading stocks with relative strength and weakness.

Relative Strength

This is the “edge” that we reference throughout our website and it is how we can identify institutional order flow. In a sentence, when the market goes down and the stock goes up, it has relative strength. You can learn all about it in The Edge section of our website. When stocks with relative strength also have other desirable traits our probability of success increases even more. Here are a few examples.

Trade Signals

When the 1OP indicator for a stock and the 1OSI indicator (Relative Strength) for a stock agree, a Trade Signal is generated (B/S). These Trade Signals can be seen on the charts across all time frames. A blue arrow represents a buy, a yellow arrow represents a short. When a stock has buy signals across multiple time frames (H1, H2 and D1) the signal is strong.

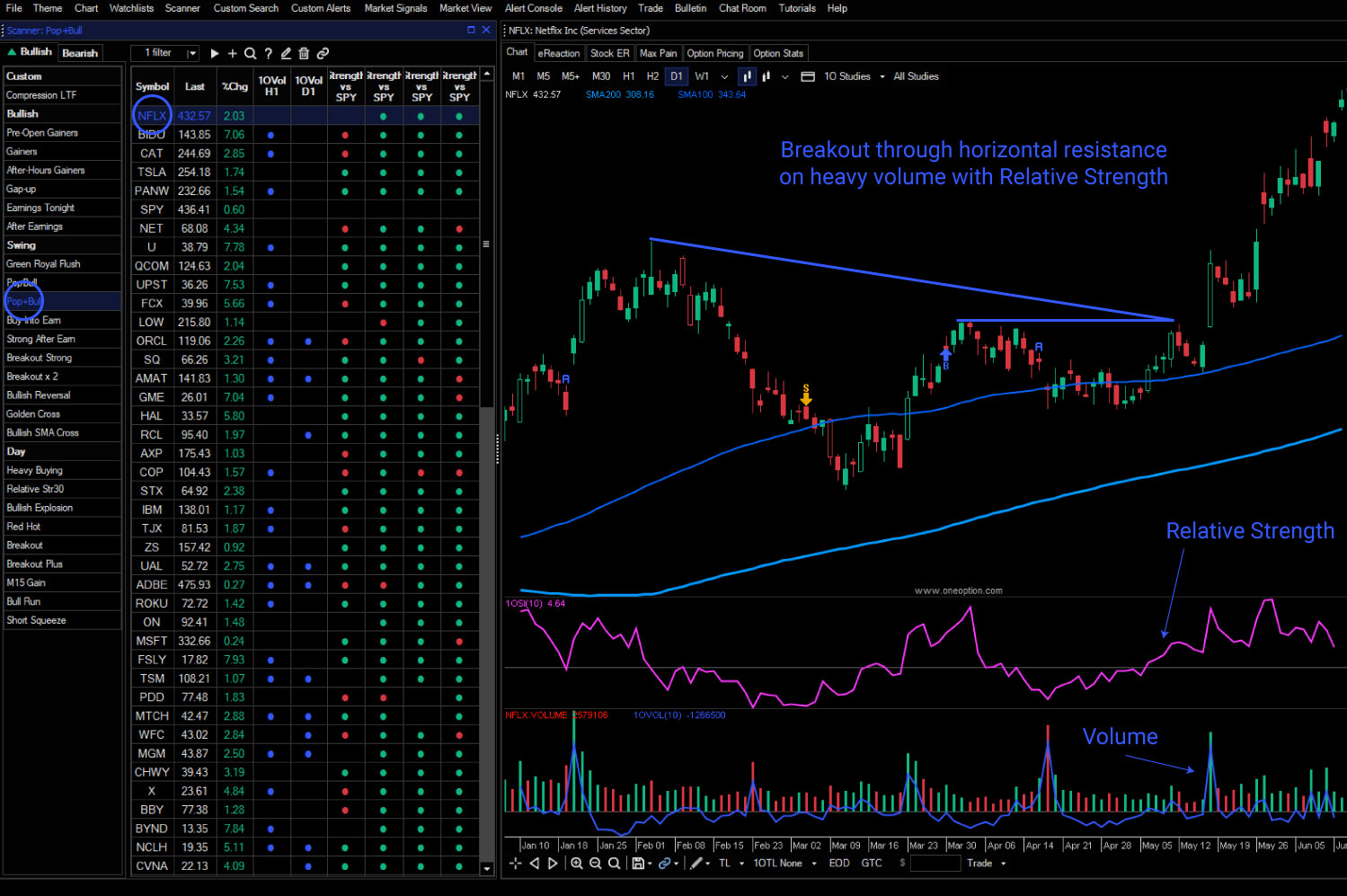

Breakouts

A stock that has relative strength is even more attractive when it also has a technical breakout. In Option Stalker Pro you can search for compression breakouts across any time frame. There are trendline breakouts that you can search for across any time frame. Swing traders might search for a stock that has relative strength and a breakout above a downward sloping trendline on a D1 basis. A day trader might use a similar approach, but use a breakout above a downward sloping M15 trendline. As you can see, the combinations are endless. In the next section we will look at some of our favorite searches and when to use them.

Option Stalker Pro Scanner

Option Stalker Pro includes pre-configured searches for swing traders and day traders. These stocks have many excellent qualities and we highlighted a few of our favorite bullish searches in this section. When members buy these stocks during a bullish SPY cycle, the odds are in their favor.

Swing Traders: PopBull

This is our favorite swing search and we check it at the start of trading each day. It looks for stocks that are breaking out of a recent D1 compression and horizontal resistance on heavy volume. Since the stock has been compressing we are catching it early in the move and these breakouts tend to be sustained. The Pop+Bull search displays stocks that were on PopBull the previous day. This search gives us a second chance to buy these breakouts.

Swing Traders: Strong After Earnings

Have you ever watched the initial earnings reaction and then forgotten about the stock? A few weeks later you notice how strong it is and you wish you had kept it on your radar. This search looks for stocks that reported in the last two weeks and that gapped higher on the news. The stock is still holding those gains and moving higher on relative strength. This search is a great way to catch those movers.

Day Traders: Heavy Buying

This is one of our favorite searches right on the opening bell. It looks for stocks with extremely high volume, relative strength and a breakout above the prior day’s high. If the stock is also breaking through technical resistance and it has stacked green candles we jump on it.

Day Traders: Red Hot/Bull Run

These are momentum searches. It takes a while for that strength to build so we suggest using them an hour into the trading session. Each search uses different variables to find momentum. RedHot is very selective. You won’t see many stocks on this search, but they will be excellent. BullRun will typically have more results, but not an overwhelming number. When members buy these stocks during bullish SPY cycles the odds of success are very high. There are many other great pre-configured searches, but let’s show you how to create your own.

Build Your Custom Scanner

In minutes you can create your own powerful searches with our Custom Scanner matrix. There is no coding and you won’t find these variables anywhere else. Start by casting a wide net and see what you catch. Then start adding other variables like heavy volume and liquid options. Use the same variable across multiple time frames. A stock with relative strength on a five minute basis is not as good as a stock that has relative strength across all time frames. The more checkboxes you mark, the higher your odds of success. Let’s create some searches.

Bull Put Spread Search

For swing trading searches we suggest using H1, H2 and D1 time frames for the search variables. Let’s say that you are looking to sell out of the money bullish put spreads on a strong stock. Let’s mark the boxes for relative strength for H1, H2 and D1. Then let’s also mark the box for Trendline 60 bullish D1. We always want the spreads to expire before an earnings announcement so let’s use the Earnings Date (Projected) filter and set it past the options expiration date. Let’s also mark Liquid Options and set it to 0-15. You can also add > 200-Day MA. Click Scan and double click on the symbols to look at the charts. These are going to be excellent candidates.

Call Debit Spread Search

If the market momentum is strong you might be looking for a short-term, at the money, call debit spread to buy. You need a stock that has excellent momentum and heavy volume. You would use ADX bullish across H1 and H2 to find that momentum. You would also mark Trade Signal bullish across those same time frames. Next you will add Heavy Volume Today, Option Liquidity > 0 and Weekly Options. These stocks will be strong and you can add move variables to reduce the list and increase your odds of success.

Option Day Trade

Let’s say that it is Friday and you want to buy a call option that expires in an hour. We call these lottery trades. You need a stock that is incredibly strong and that has a very good chance of marching higher right into the close. We can use ADX, but we are going to look for a stock that is near its high of the day. Select Range% 90/10 bullish and use H4. This means that the stock is in the upper 10% of its four hour range. Also add heavy volume, Liquid Options, > Prior Day High and Relative Strength across multiple time frames. If you have many results, look for Heavy Volume M15. That means there has been a volume spike in the last 15 minutes. These are going to be some very strong stocks and we do these trades Friday in the chat room. By the way, we can search for volume spikes in the last 5 minutes (or any time frame) for any stock.

Stock Day Trade

Let’s say that you are looking for a strong stock to day trade during a market pullback. As the market drops, the stock treads water and it compresses. That is a sign of relative strength and we are going to select Compression (In) M5. We will also add Heavy Volume Today, > Prior Day’s High and Buy Signal M5, M15 and M30. As you look at the stocks, identify the compression on the chart and drop an alert line at the highest price during the compression. When the stock breaks out, you will get a pop-up alert in Option Stalker Pro.

New Features

Advance Your Trading With Modern Tools

Automated Trendlines

Introducing our game-changing feature: Automated Trendlines. Say goodbye to manual chart drawing and hello to precision trading. With our cutting-edge rules, Option Stalker Pro automatically draws key trendlines on daily stock charts to help you track key levels of support and resistance monitored by institutional investors. Experience the ease and effectiveness of effortlessly tracking these levels to stay in sync with the Smart Money to advance your trading potential.

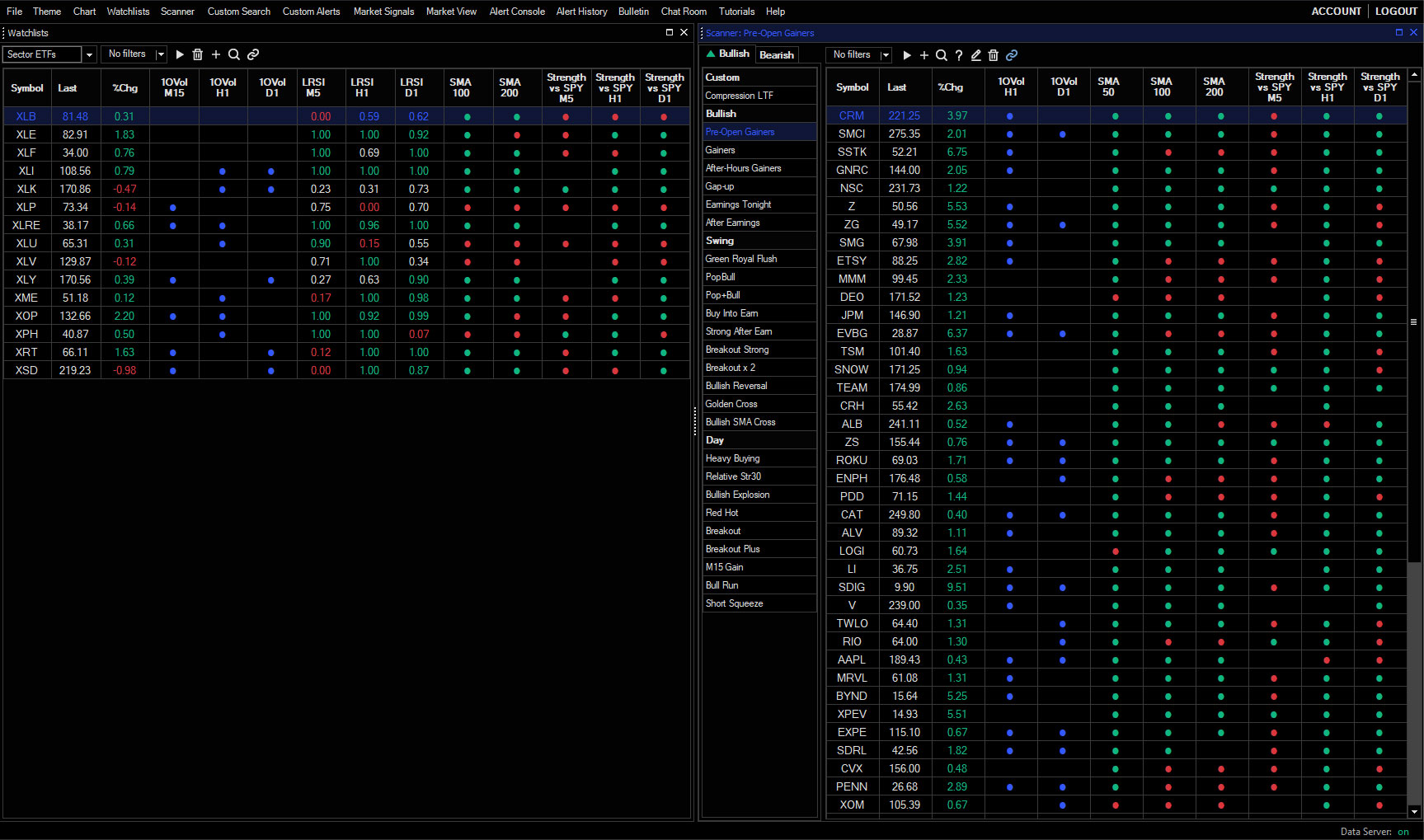

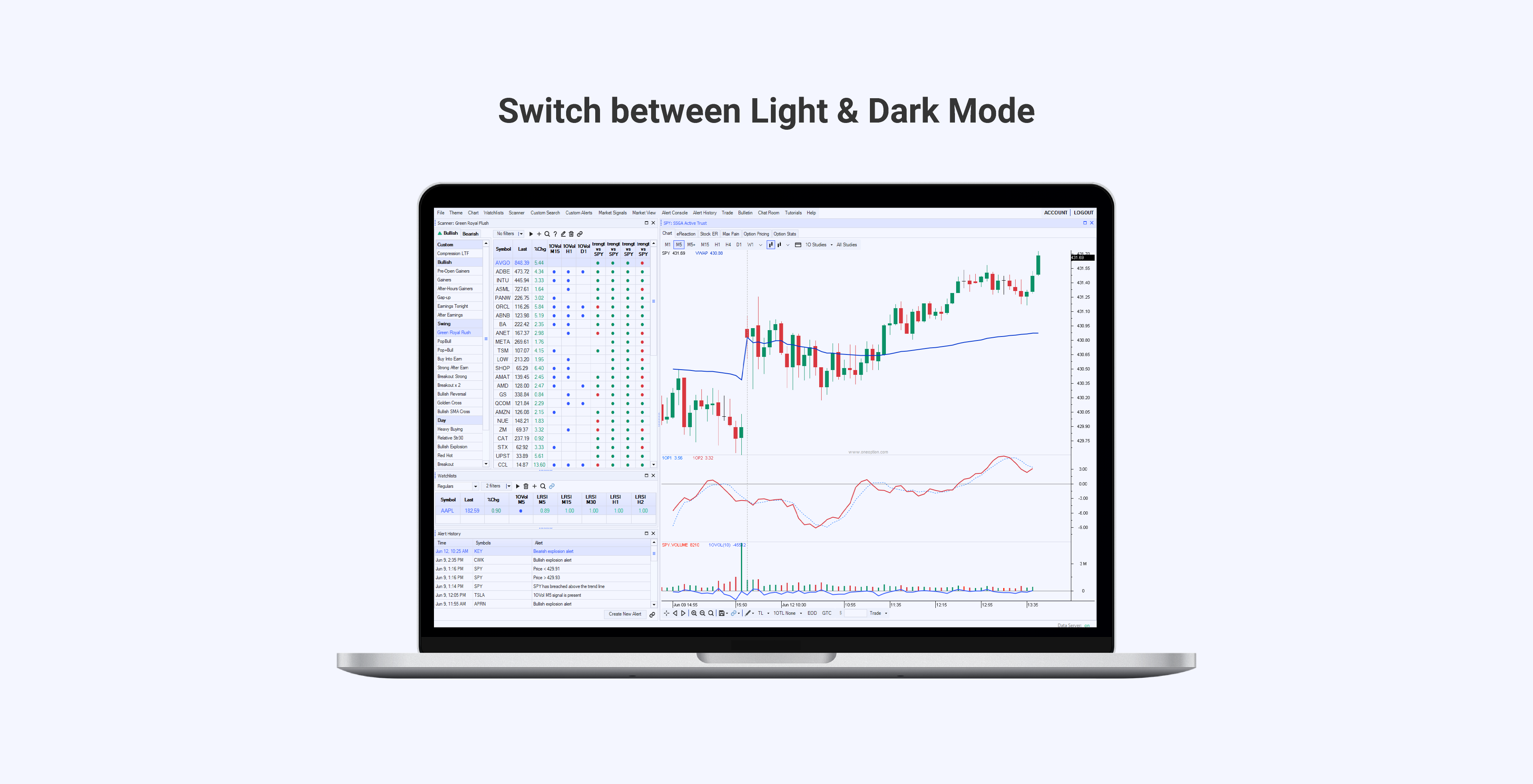

Custom Table Columns

Boost your trading with Custom Table Columns and unlock unparalleled customization capabilities. With this new feature, you have the power to tailor the columns on your scanners and watchlists to your exact specifications. Seamlessly include indicator values for multiple timeframes like Trade Signal (B/S), Strength vs SPY, LRSI, 1OVol, and daily SMAs to instantly grasp the Relative Strength/Weakness of a stock in a single glance, without diving into charts right away to make swift, informed stock selection decisions.

Rich Indicator Alerts

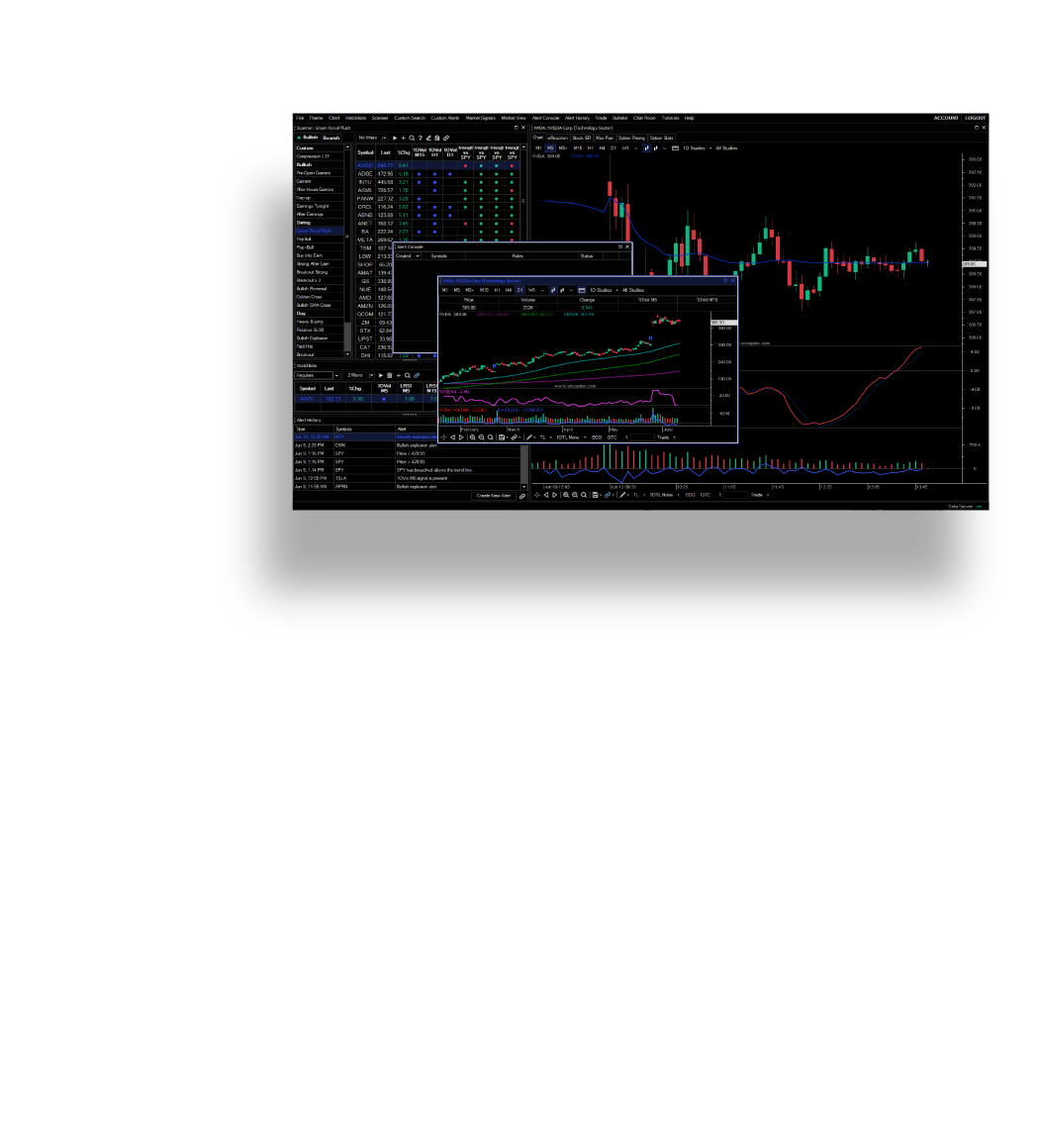

Experience the power of Rich Indicator Alerts, the ultimate tool for optimizing your trade entry and management. With this groundbreaking feature, you have the ability to create custom alerts based on stock indicator values, tailored to your unique trading strategy. Set up alerts that trigger on advanced indicator values, allowing you to stay one step ahead of the market. Whether it's multiple rules or multiple symbols, this feature offers unparalleled flexibility. Build alerts effortlessly from a list or chart, empowering you to closely track a stock and patiently wait for the perfect conditions to align and take control of your trading success like never before.

AVWAP Institutional Analysis

Stay ahead of the game and make informed trading decisions by harnessing the insights provided by AVWAP. This indicator, Anchored Volume Weighted Average Price, allows you to anchor VWAP at custom locations or significant dates, such as the start of the month, quarter, or earnings releases. By doing so, you gain access to crucial price levels closely monitored by institutional investors. For day traders who track institutional money and seek to capitalize on relative strength and weakness, these price levels are indispensable considerations. Elevate your trading strategy and align yourself with the forces shaping the market landscape.

Plus All Of The Essentials

Trade Signals

View green and red arrows on the charts for all time frames.

Advanced Charting

Over 100 technical studies and four proprietary indicators.

Alerts

Set it and forget it: Add horizontal and diagonal alert lines to charts.

Order Entry

Trade from the chart and place complex options orders.

Watchlists

Lists display buy/sell signals (M5-D1) for each stock.

Earnings Dates

Important dates are shown on charts and used in searches.

Sector Strength

View Buy/Sell signals for sector ETFs and drill down to sector stock performance.

Education

Keep learning with access to our ever-growing members-only lessons and content. Priceless.

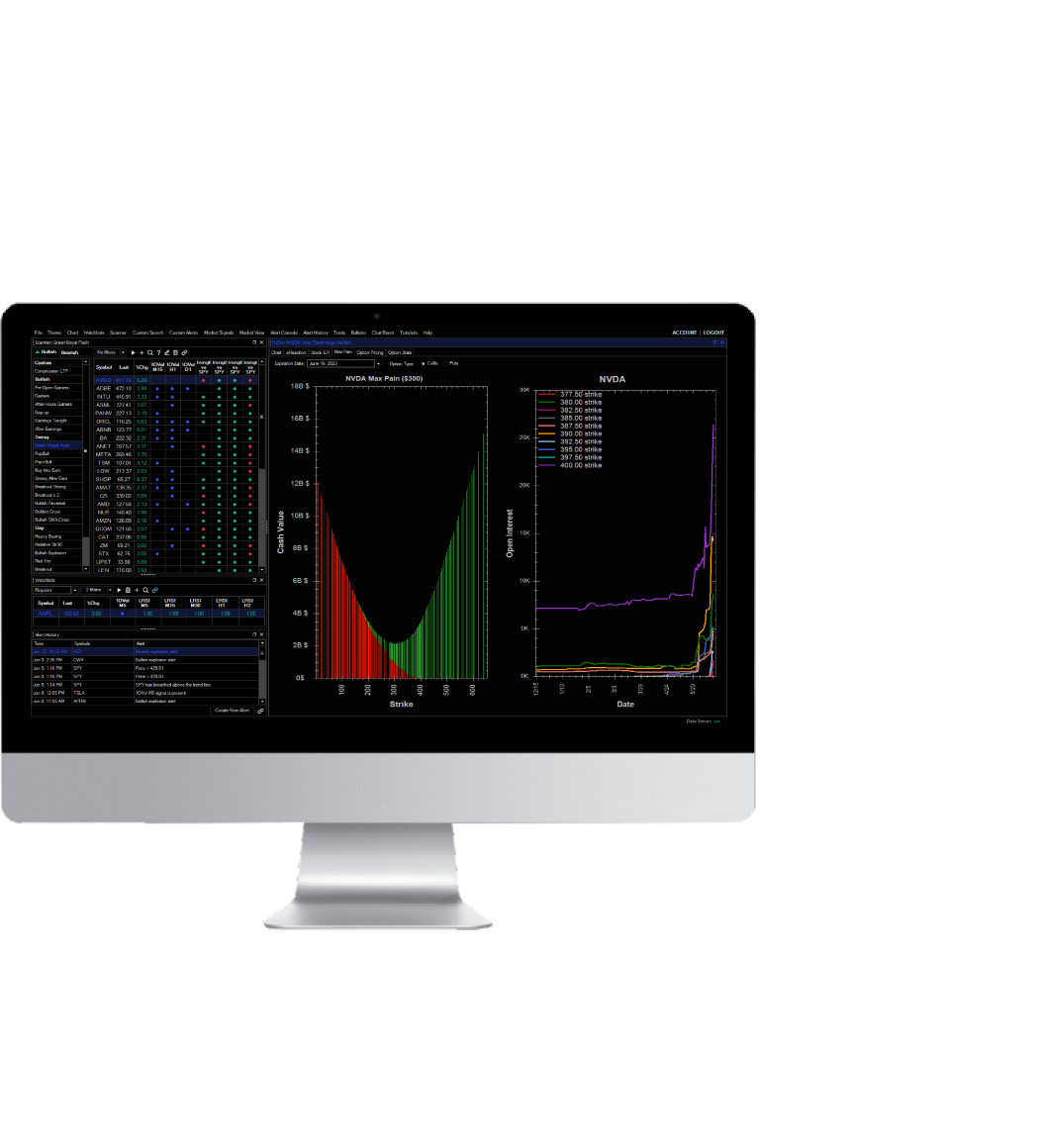

Option Analytics

IV and OI charts. Search for liquid options and earnings plays.

What Users Say About Pro

Download Option Stalker Pro on Windows

From your Dashboard, click the download button and Option Stalker Pro will install on your computer. It is a desktop software application and it is NOT browser based. To launch it, look for the OneOption logo on your computer desktop and click it. The log-in credentials are the same for Option Stalker Pro and the website.

Pricing

With an Option Stalker Pro subscription you also receive access to Option Stalker and the chat room. View our pricing page for more details and to compare features.

Compare ProductsMonthly

Quarterly

Annually

OneOption has negotiated this special rate with Tradier Brokerage – $10/month unlimited commission-free stock and option trades. Tradier Brokerage does not restrict data like other brokers do and I have always been able to reach their support desk. From my experience Trader Brokerage typically opens accounts within 24 hours.

Click here to open an account.

The Option Stalker Pro manual is available here. It is a fantastic resource and it describes the searches in detail. We highly recommend spending time reviewing this manual. There are tools that will help your trading.

Option Stalker is a Windows based software program and Mac users need to have a Windows virtualization program like Parallels installed on the computer. Many Option Stalker members are successfully using Mac computers with these virtualization programs.

Alternatively, Mac users can use an Apple solution called Boot Camp that installs Windows on the hard drive. This will allow you to run Windows based applications like Option Stalker. To learn more please click this link to Apple’s website.

Yes. Option Stalker has excellent order entry and multi-legged spreads are a snap. Just click Trade at the top or bottom of Option Stalker. The pop-up will default to the stock in your primary chart and it will immediately call up an option chain. If no options are selected the order will assume you are trading stock. For more information on placing orders, please refer to the manual.

Visit the product pages for Chat Room, Option Stalker, and Option Stalker Pro. They describe everything you need to know to get started using our tools. Additionally, please visit the Pricing Page for a side-by-side feature comparison. Option Stalker Pro is our flagship product and we suggest you read it’s dedicated page and manual carefully to understand it and the system we trade. Together, we highlight all of the features and describe the searches and when to use them and it explains the search variables offered in Custom Search.

In short, if you are an active trader you will want Option Stalker Pro.