Our mission is to teach a proven system and to provide traders with the tools to master it.

Peter Stolcers, founder

Your Success Is All That Matters

If you want to learn how to trade, you’ve come to the right place. It won’t be an easy journey, but we have everything you need. Our members are living proof that this system can be learned and replicated.

Others have gone through the process and so can you.

Review these testimonials from members who have learned our system and dramatically improved their win rate. Click on their photos and see what they have to say. Click here to refresh for new testimonials.

Here's What We Traded Recently

This is a simplified preview of our chat room last week. Notice that many traders are posting great stocks and the action is widespread. We are a laser-focused community trading a systematic approach.

@kaddie: I’m short RKLB, it was going really well yesterday. Added at $19.00 when spy broke down from HOD. Stock ended the day at $18.40. My average is $19.50. News came out after hours and the stock popped 10... View

@H.S. Wren: Are you over leveraged to the point to where if you hold and it breaks the 100D SMA and closes above it on the daily that you are going to be in a world of pain? · @kaddie... View

@DannyS: Hello traders! I wanted to share my retrospective with the PANW trade I (and a lot of traders in the chatroom) took.I am satisfied about how I entered the trade, but to be honest I am disappointed abo... View

@lilsgymdan: see NKE as a reliable short. this is only anecdotal but it seems to work even when the TA isn't ideal - a reverse BA View

@BigUzi: BROS heavy reds on confirmation below the 50, not the most bearish ticket though View

@lilsgymdan: see NKE as a reliable short. this is only anecdotal but it seems to work even when the TA isn't ideal - a reverse BA View

@Hariseldon: I see my NVDA Puts were assigned - so I made the premium on the Puts and now own 4,000 Shares (I bought another 1,000) at an avg of $116.38 View

@Isidore: Exit Short FSLR June 150p for a 0.90 loss per contract if a stock can't have RW in a move like this I dont want to be around when SPY starts to bounce. View

@Tech tok: Exit Short CRWD - profit - paperExit Short TSLA - profit - paper View

@UseLESS_Trades: Long HMY 14.11 small size. D1 breakout, volume and is defending vwap better than gold. Market might be bouncing here which is not ideal but after all this selling its possible SPY only tests the 8ema.... View

@AZRobert: Short GOOGL $157.30 PAPER Seems to be weaker than the market by a little. View

@PhilMyOrder: You're going long today? That is not what is being taught here. · @UseLESS_Trades: Long HMY 14.11 small size. D1 breakout, volume and is defending vwap better than gold. M... View

Please consider only making call outs when a posted trade is blatantly against the System (like going long a stock that is down).

@Hariseldon: This is the toughest part of the day - bearish trend - but now you are waiting for a bounce - patiently View

@RogerT: Is it rare for a bounce to never occur after bearish trend moves? View

@KaibabCowboy: Would GOOGL fit the bill? · @Hariseldon: During the bounce (if we get one) look at which stocks aren't moving with it View

@No_Faithlessness: RDDT entering 10/30 gap View

@AnyOtherName21: Not until it crosses 104.11 · @No_Faithlessness: RDDT entering 10/30 gap View

@JBS: Even on the gap break, I would be mindful of psychological resistance at $100 on RDDT View

Right now I am still only day trading as I am not comfortable holding swing shorts with how sensitive the market is to any Tariff news. With Apr 2 coming I have no idea what Trump is going to say/do and I fear that even a simple walkback on any of them or some agreement could cause an explosive bounce.

Any thoughts on this or are how you all are approaching it?

RDT does have a discord where more casual banter takes place (please don't ask for link, you have to find it yourself on the subreddit), but in general Pete suggests traders to not be distracted at all when trading.

@JJohnson: RDDT could be about to fall into a big gap View

@JJohnson: RDDT could be about to fall into a big gap View

@lilsgymdan: october 2023 View

@RogerT: Is it safe to assume that most recent lines are more reliable compared to older lines? · @lilsgymdan: october 2023 View

@Dave W: 10/27/24 · @HLLL: @Dave W where does that line start from? View

@dylanros: Question Looking for some feedback on thought process here from the more experienced traders:Right now I am still only day trading as I am not comfortable holding swing shorts with how sensitive the m... View

@Pete: It doesn't matter what my thoughts are. If you don't have the confidence to hold a trade overnight then you are not going to hold a trade overnight. If you force yourself to hold a trade overnight you... View

@cste: Question Seems like the SPY @558 is a point of resistance here, would it make sense to exit some swings with the intention of entering in a better price, e.g. anticipating a small bounce? (novice trad... View

@Pete: You have to frame your question better. $558 is resistance? Do you mean support at the lod? Would it make sense to exit some swing? Are we talking longs or shorts? Re-enter on a small bounce? I think... View

@cste: I meant 'support at the lod', yes. The question was to exit short swings and re-enter them on a small bounce as you said. And yes, you did answer my question later, thanks. ... View

@H.S. Wren: TSLA is a very interesting short right now. Lots of resistance points bunched into one tight area in the 5M right now but the RS strength has been strong today. The daily chart clearly is showing a we... View

@Phradeus: RFK SAID TO SUPPORT BAN ON SODA BEING PURCHASED WITH FOOD STAMPS View

@RogerT: I never realised that simply examining charts could be so gratifying/satisfying View

@H.S. Wren: Explain · @RogerT: Short TSLA 264.88 View

@Lightsey: @H.S. Wren, I notice you are very quick to be extremely critical of folks being bold enough to post entries and exits. I’m not sure if you intend to come across as direct as you are, but I recall you... View

@H.S. Wren: Hmmm, apologies if I'm coming across too direct or too critical. Genuinely not trying to be. Just trying to challenge people to think about the moves they are making when I see something that seems re... View

@UseLESS_Trades: you looked at ASML and he shorted AVGO · @Hariseldon: You mean 672.5? · @Mladen: Short AVGO lotto puts 167.5 for .18 ... View

@Pete: What do I want to see Mon? I expect some of today's red candle to be given back. I want the halfway point to hold. I don't really care about anything else, I know sellers are in control and I am just ... View

@Don Nelson: Pete, in your video today at the 4 minute mark, you talked about going short when a 5 minute candle “took out” yesterday’s low. Do you wait for confirmation that yesterday’s low will become resistance... View

@Kal Kaz: i missed the move today due to doc appt. I am trying to remind myself that i missed 'a' move, and not 'the' move. I also was patient and did not fomo into anything. I will continue to be patient and w... View

@SpecRacing: I don't know how a group like this possibly exists, but i can't believe my luck finding it in January and watching a 10% correction have me up 20% while everyone outside here is watching their money d... View

Short AMDS $18.05 (1 Share)

Short NTAP 5/16 95p for $8.20

Short TSLA PDS 260/265 4 APR for 2.35

Short LEN at $114.17. Added to all existing swings (only one of which I posted) and opened two more today.

Short Exit RDDT swing puts took loss didnt stay in gap fill

Short AMD $103.27

Short AMD at $103.08

Exit Long PARA spec call from last week (expiring worthless) Short FL $16P Apr-17 $1.70 Short CZR $27.5P Apr-17 $2.33

Short NUE adding to a loser but it maintained my swing thesis under the 100 and the 8/15EMA and i had a greedy entry before - avg price $121.23 - still fully sized for a bounce to the 15EMA

Exit Short HIMS - 28.97 - profit - paper

Exit Short AVGO lotto for .25

Exit Short ASML lottos rest for $3.66

Short DIS new avg $98.71

Short CZR 5/2 30p for $4.70

Short ORCL 5/16 155p @ 16.65

Short PYPL 5/16 70p @ 6.60

Exit 1/2 @$2.60 @ican: Short ASML Lottos 677.5 for 1.29 View

Exit TSLA at breakeven

Short AVGO lotto puts 167.5 for .18

Short ASML Lottos 677.5 for 1.29

Long Exit WELL trim some more at 153.05

Short HIMS - 29.15 - paper - swing

Short OKLO - 22.39 - swing - paper

Exit Short TSLA 263. 71

Short TSLA 264.88

Exit Short PLTR $85.47

Exit Short AA $30.74

Exit Short took 80% profit SRPT short from 3/19 bounce ty Dave

Short RDDT swing must hold in gap to hold over the weekend

Short GOOGL Lotto $152.50 for .08 - 100 Contracts (thanks Dave. W)

Short GOOGL lotto 152.50 for .08

Exit Short DOW via Puts Apr 4 $35.5 - for $1.38

Short TSLA $263.02 (1,000)

Long NVDA sold 109p 4 APR for 2.85 with the intent to be assigned.

Short AVGO $167.00

Short AA $30.76

Exit Short NKE took nice profits on half of position holding the rest

Short TROW - $95.25

Exit Short NNE at price 25.81 - profit - paper

Exit Short CRWD at price 354.08 - profit - paper

Exit SPY Puts for a profit - holding the calls

Exit MRVL at 61.52

Short SNOW 149.52

Short DOW Puts Apr 4 $35.5 for $1.29

Exit Short DASH 184.31 $2 profit

Exit SOFI Shares $11.82

Exit Short took profit AVGO trying to get flat to leave early for the day

Exit Short PLTR $84.70

Exit SWKShort for .64 gain. Better ways to allocate capital to the short side.

Exit TSLAShort for 6.78 gain on shares

Long Exit trim WELL $152.45, still holding half

Exit Short AVGO PDS - $1.10 very nice

Exit Short AVGO pds took profits 30+%

Short PLTR $84.46

Short HIMS @29,58

Short MSFT 5/16 400p @ 24.70 swing

Exit Short AVGO $167.07 (too random)

Short AXP 5/16 280p @20.50 swing

Short AVGO $167.35

Exit Short MRVL $61.83

Short AVGO pds ty Dan

Short AVGO 167.5/165 PDS EXP 3/28 - $0.74 thanks dan

Short NKE

Short MRVL $61.95

Short MRVL 62.12

Short AVGO 167.5/165 pds for 0.70

Exit Short MRVL - I closed the position at 10:24 at 63.21 but couldn’t post my exit

Short DASH 186.31

Exit Long HMY 14.03 scratch. still inside a wedge but no "humpft"

Short NNE - 25.92 - paper - not bouncing

Exit Short RY .10 loss

Exit Short GOOGL 156.30 for $1 profit. Entered too early maybe.

Short CRWD - 355.83 - paper

Short GOOGL $157.30 PAPER Seems to be weaker than the market by a little.

Long HMY 14.11 small size. D1 breakout, volume and is defending vwap better than gold. Market might be bouncing here which is not ideal but after all this selling its possible SPY only tests the 8ema. Leash around ~19.90

Exit Short PYPL $65.85

Exit Short LNW $90.46

Short SOFI added Ave $11.86

Short Exit RGTI trim most $7.86

Exit Long HMY $14.10 (stop)

Exit Short GOOGL 172.5p April 17 for 5 dollars a contract I am expecting SPY to bounce around here. still a bit of room on GOOGL to support

Exit AVGOShort for $3 on shares

Exit Short AVGO - $11.90 @ksalomov: Short AVGO using puts Apr4'25 180 - avg $10.56 View

Exit Short PEP for loss

Short RY 113.66

Exit Short NOW $803 for $10 profit a share.- This was a swing short I posted originally on the 21st

Short SOFI $11.91 starter shares

Exit Short DECK May 16 130p for 4.40 dollars a contract stock approaching support and want to take a few chips off the table here

Exit MRVLShort for 1.30 gain on shares 2x size. still holding puts

Exit Short CRWD - profit - paper Exit Short TSLA - profit - paper

Short PYPL $66.12

Exit AAPL Short with .50 profit per share (1000)

Exit Short 592.5/590 PDS for 1.55, sorry mods delete previous comment please, forgot to add the legs for the spread

Exit Short META PDS for 1.55

Exit Short AVGO pds took 27%. Don't like the rs it's exhibiting this morning

Exit Short FSLR - was starter size loss of $1.2 per contract

Exit Short FSLR June 150p for a 0.90 loss per contract if a stock can't have RW in a move like this I dont want to be around when SPY starts to bounce.

Short AVGO using puts Apr4'25 180 - avg $10.56

Short MRVL add new avg. 64.52

Short TGT $103 starter

Long HMY $14.31

Short META 592.5/590 pds for $1

Short LNW $91.70

Short LNW $61.70

Short NKE

Short NKE 64.79

Short /ES 5710. My ave on 3X is 5726. My ave cost on the swing is higher than the current price so I am adding from a position of strength and not weakness

Exit Short TGT 103.45 for $1.30 gain on swing. I like the short, but the stock has been very stubborn and choppy at this level. The market has been choppy this morning. On a nice drop in the stock on the open when the market is choppy I will take the gain and keep it on my radar for reentry

Exit VSCO with a profit at $18.98

Exit ADBE pds for $1.05 profit

Exit ARM at 110.77 win a small profit better shorts out there

Grouped By Trader

Notifications

your_Username

Active

Resources

Bookmarked Messages

Daily Bulletins

New Features On Option Stalker Pro

Advance Your Trading With Modern Tools

Trade Our Buy & Sell Signals

Your confidence will grow with each positive outcome.

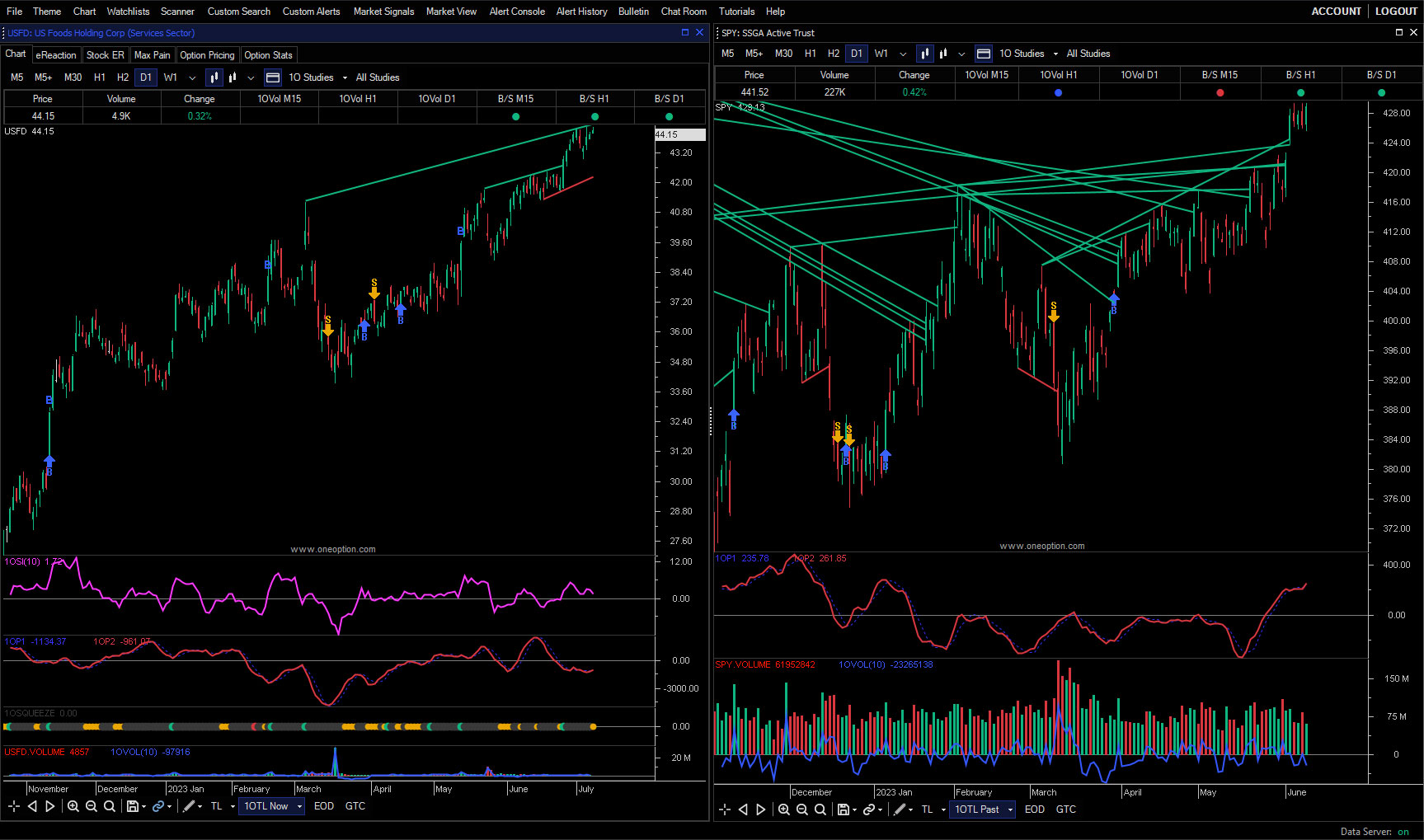

After years of refinement, we've taken our 1OP Indicator to the highest level. It now produces accurate buy and sell signals across multiple time frames. They are available in Option Stalker and Option Stalker Pro. View the arrows on the charts, use the trade signals as a variable in your searches and set alerts for them to improve your entries and exits.

We took random symbol requests during this one hour live event. Watch it now and gauge the accuracy. This article explains how to trade these signals.

Don't trust any promotional hype. Watch the video, read the article and them test them yourself during the free two week trial. You'll be amazed at how well they work.

Automated Trendlines

Introducing our game-changing feature: Automated Trendlines. Say goodbye to manual chart drawing and hello to precision trading. With our cutting-edge rules, Option Stalker Pro automatically draws key trendlines on daily stock charts to help you track key levels of support and resistance monitored by institutional investors. Experience the ease and effectiveness of effortlessly tracking these levels to stay in sync with the Smart Money to advance your trading potential.

Rich Indicator Alerts

Experience the power of Rich Indicator Alerts, the ultimate tool for optimizing your trade entry and management. With this groundbreaking feature, you have the ability to create custom alerts based on stock indicator values, tailored to your unique trading strategy. Set up alerts that trigger on advanced indicator values, allowing you to stay one step ahead of the market. Whether it's multiple rules or multiple symbols, this feature offers unparalleled flexibility. Build alerts effortlessly from a list or chart, empowering you to closely track a stock and patiently wait for the perfect conditions to align and take control of your trading success like never before.

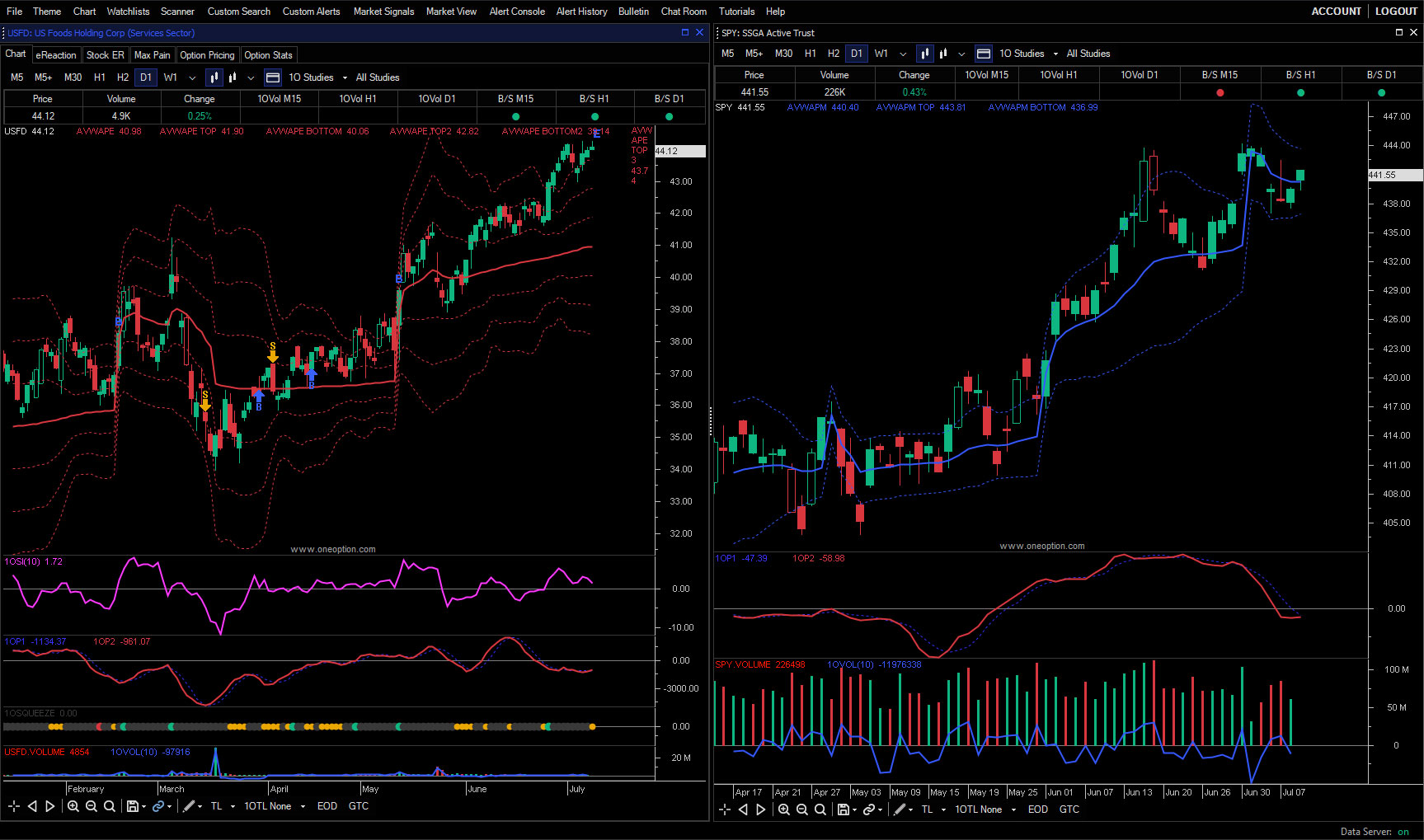

AVWAP Institutional Analysis

Stay ahead of the game and make informed trading decisions by harnessing the insights provided by AVWAP. This indicator, Anchored Volume Weighted Average Price, allows you to anchor VWAP at custom locations or significant dates, such as the start of the month, quarter, or earnings releases. By doing so, you gain access to crucial price levels closely monitored by institutional investors. For day traders who track institutional money and seek to capitalize on relative strength and weakness, these price levels are indispensable considerations. Elevate your trading strategy and align yourself with the forces shaping the market landscape.

The system works

Market Analysis and Stock Picks

We record two free YouTube videos each week that start with a review of the prior “pick of the day” and evaluate the trade, then conduct market analysis using Option Stalker Pro to find a new “pick of the day”. Click below to view recent videos.

How To Get Started:

Learn The System

Our trading system is your path to clarity and the Start Here section of our website will quickly get you up to speed. Each resource is an important building block. When you have reviewed the materials you’ll understand what the system is, why it works and the tools we use to find opportunities. The effort you put into learning the system and the tools is critical. Don’t rush the process. Armed with knowledge, you’ll be ready to see the system in action.

Meet The Traders

It’s time to register for the Free Trial. The action will be fast and furious. You’ve studied the patterns so you’ll understand the basis for each trade posted in the chat room. You’ll have access to Option Stalker Pro. It has an incredibly powerful search engine and is the source of all of our trade ideas. The two-week trial will fly by so please make sure that you are prepared. We want you to maximize it.

Join Us

You are going to learn more than you can imagine in a very short period of time. The traders you meet during the free trial started right where you are now. You’ll see them enter and exit great trades with ease and they are living proof that this system can be learned and replicate. We’re confident you’ll want to join our team and we’ll help you find the product that suits your needs.

The best way to get started is to read through the entire website. We’ve included an incredible amount of educational content to teach our systematic approach. You’ll know what it is, why it works and how our tools help you exploit the edge that we trade. The Start Here section will lead you through the process step-by-step.

I have to answer this question with a question. Do you trust track records? We don’t because many of these so-called track records are “cherry-picked.” We offer many ways for you to check our performance.

- During your free trial ask members in the chat room if they are making money. We don’t mind if you do this and we won’t interfere when members respond.

- Watch the trades in the chat room during the free trial.

- Watch the YouTube videos. In each daily video we recap the trades highlighted in the prior video. Go back weeks or months and watch those videos. In fact, check the YouTube videos that were posted during the biggest market crash since the Great Depression

We don’t want to win you over with old trades. We want to show you how we are making money today. That’s why we offer a free two-week trial. Visit Start Here to learn how to begin.

You will find a detailed comparison of our products and features on the Pricing Page.

We suggest starting with a shorter term subscription because we do not offer refunds. If you like our trading technology after using it for a month or two, subscribe to a longer term and save money. The days you have left on the old subscription will be added to the new subscription.

Visit the product pages for Chat Room, Option Stalker, and Option Stalker Pro. They describe everything you need to know to get started using our tools. Additionally, please visit the Pricing Page for a side-by-side feature comparison. Option Stalker Pro is our flagship product and we suggest you read it’s dedicated page and manual carefully to understand it and the system we trade. Together, we highlight all of the features and describe the searches and when to use them and it explains the search variables offered in Custom Search.

In short, if you are an active trader you will want Option Stalker Pro.

Yes. We have an extensive library of articles located under The Edge in the top menu. You can find step-by-step instructions on how to explore our website in the Start Here page. Please begin with Our Trading Methodology. We suggest that you read as many of these articles as possible. Some of them are available to the public and some are only available to paid members. You will also find educational videos and our eBook. Annotated charts are posted to the chat room to highlight specific trading patterns. In short, everything OneOption touches has an element of education.

Learn The System

Start With OneOption, free.

Start Free TrialNo subscriptions. No annual fees. No lock-ins.