Originally written for r/RealDayTrading Jan 09, 2022

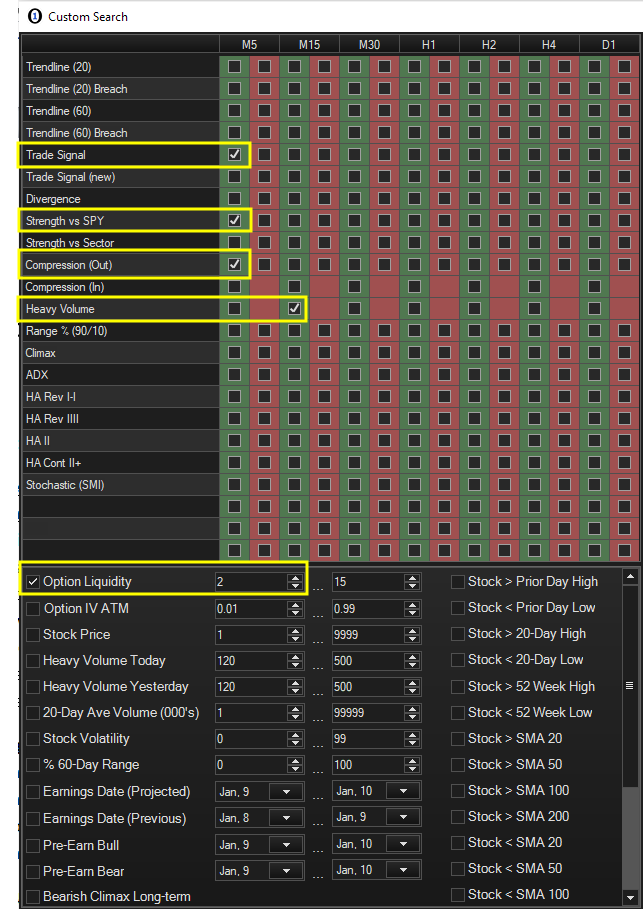

Many of you are going through a similar process that I went through 20 years ago. You are using trading platforms and displaying studies for visual confirmation, but that is not efficient. Imagine being able to search for volume spikes and relative strength across multiple time frames. Imagine being able to add other variables to increase your odds of success. I call these “checkboxes.”

There was not a product on the market that would do this, so I built one.

Find a stock with:

- Excellent options liquidity

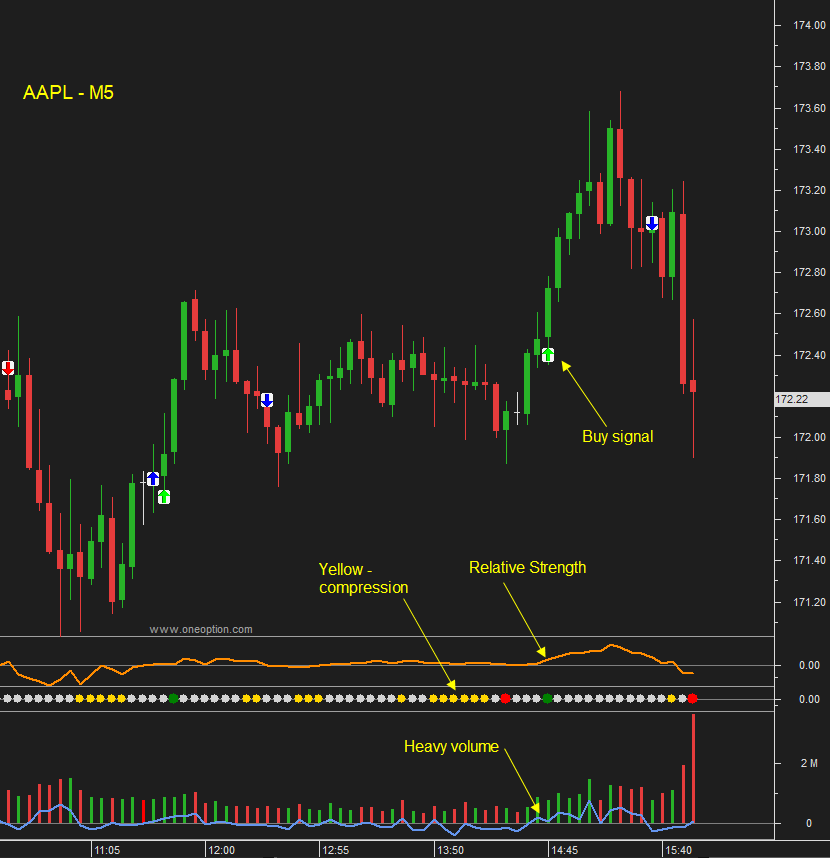

- Relative strength vs SPY on an M5 basis

- Heavy volume M15

- Compression Out M5

- Buy signal M5

AAPL came up on this search Friday and I posted it in the chat room. The combinations of variables and time frames that you can use are limitless. Day traders can use shorter-term variables and swing traders can use longer-term variables, but I like to use both. Then I know that I have a longer-term tailwind for the stocks I am day trading now.

I hope that some of the Reddit sub members who use Option Stalker chime in.