Originally written for r/RealDayTrading Dec 26, 2021

In Part 1 I developed my longer term market opinion. The market had bounced off of major technical support and this dip was being bought aggressively into year end. The market gapped up Thursday December 23rd and I needed to make sure that the gains were holding. In Part 2 I identified that buyers were still engaged and that a market breakout was pending. While I waited for market confirmation I searched for stocks with relative strength, heavy volume and technical breakouts on a D1 chart. TSLA looked strong and I described why I liked it in Part 3. At this juncture of the decision making process I am confident that the market has a strong bid and I am watching the gap higher to make sure the gains hold. I don’t mind a small retracement, but I do not want to see organized selling and I do not want much of the gap to be tested. If that was happening it would give me more time to find my trades because it would take longer to confirm market support. The market was compressing and all of the gains were holding. I also had a bullish 1OP divergence forming for the SPY and it was just a matter of time until the market made a new high of the day.

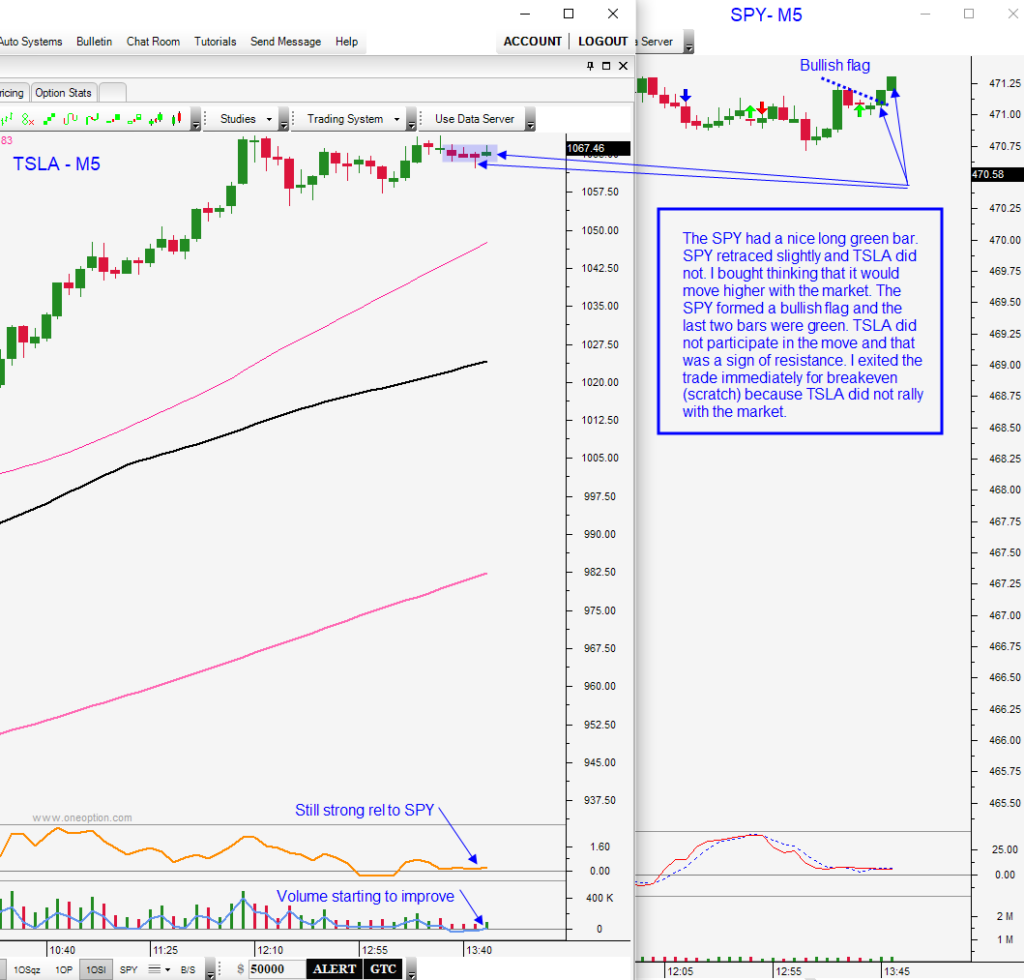

TSLA was on my radar. In Part 3, I mentioned all of the desirable characteristics for TSLA D1. Now I was comparing TSLA to the SPY on an M5 basis. I wanted to see relative strength, heavy volume and a technical breakout on a M5 basis as well. As you can see in the chart below, TSLA was showing signs of strength. The stock was able to hold the prior day’s gains. It easily moved through the high of the day and the prior day’s high. It had relative strength and strong volume. The trend was strong and that could be seen by the green candles it was stacking. It was going to test the 50-day MA and I wanted to see it move through with little to no resistance on the first attempt (another sign of aggressive buying). As the stock was testing the 50-day MA, the SPY dipped for a few bars. During that time TSLA made higher lows and the stock did not budge. If there was going to be profit taking, it would have happened at that resistance level and it would have happened on that tiny market dip. Instead, the stock prepared for its next leg higher. This was the “tell” that buyers had the upper hand and it was time to buy.

Once I entered the trade I wanted to see follow through buying for the market and the stock. The greatest threat to the position was light pre-holiday trading and the chance for dull trading the rest of the day. If the stock was going to make a move, it had to be now. I could lean on the 50-day MA and use that for my stop, but that is not how I manage my trades. I will write a future article about stops so let me keep this brief. If you are having problems with your stops, you are looking in the wrong place. Your entry is poor and that needs to be your focus. Most of my trades take off immediately and I place my stop above my entry once I am in. Then I just have to manage profits.

TSLA continued to show great relative strength and I scaled out of the position on the way up. I watched the market dips very carefully and I still had half of the position on when the market dipped in the middle of the chart. TSLA continued to move higher during that market dip and that told me it still had another leg higher in it. When we got that long green candle I took the remaining gains on the position. Not because I was bearish, but because I was very happy with the gains on what was likely to be a lackluster pre-holiday trading session. The market was showing signs of resistance and I needed to respect that.

I did try another TSLA trade later in the day. The stock remained strong and the market showed signs of strength. The SPY had a nice long green candle that retraced slightly (right-hand side of the chart below, the last seven candles). TSLA had remained close to the high of the day and it looked ready to release. TSLA did not dip with the market when that SPY long green candle was challenged and I liked that. However, when the SPY had two nice green bars (bullish flag) and TSLA did not move higher, I placed an order to exit TSLA for a scratch and I was filled. If TSLA had a delayed response and it rallied, I could have re-entered. My mindset was to keep the gains from earlier in the day and not to give them back. It was a light volume session and I needed to error on the side of caution. I got the market move I wanted and the stock did not “behave.” Why would I wait for TSLA to stop me out of a pre-determined price level? I wouldn’t do that. The stock did not do what I expected and I needed to get out now.

If you get Part 1 – Part 4 right, you can trade any options strategy you want and make money. On an expensive stock like TSLA with great option liquidity, I prefer to day trade deep ITM options that have at least a week of life. Why don’t you trade near-term weeklies? Time decay. Why don’t you go farther out in time? I don’t plan to be in the trade for more than a few hours. Why do you buy ITM options? High delta. TSLA moves like the wind and I can usually bid just below the current bid and get filled in a few minutes on these “dips” so I try not to chase. If I need to be more aggressive splitting the bid/ask usually works. Some traders might prefer call debit spreads and some might prefer put credit spreads. Some traders might choose to trade stock and I do this for most of my day trades because the liquidity is better. I really don’t want to answer… “can you do this”… and “can you do that”… options strategy questions. The answer is yes. Get the market right and get the stock right and your odds of success are great no matter what you do.

If you are just starting out, you have no business trading options. You have to focus on the first four parts of the process. The market is 70% of the puzzle and the stock is 25% of the puzzle. Until your win rate is greater than 75% you should not trade options and it could take you years to get there. Options will simply exaggerate your mistakes and you will lose your capital faster.

In Part 5 of this series, I am going to wrap this up by addressing entries, stops, and targets.

Continue Reading:

Previous Articles: