Wednesday’s Stock Option Trading Strategy!

Volatility can be good for option trading if you can predict market direction. On a day-to-day basis, stock options are whipping around in value. Once this uncertainty filters through the market, I believe a year end rally will materialize.

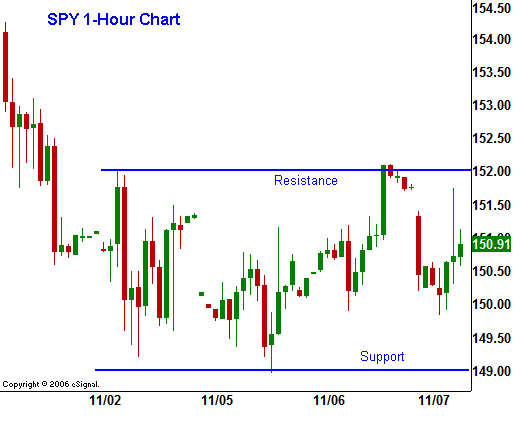

Yesterday the market staged a nice rally. If you look at today's chart you can see that since the big drop last Thursday, we are in a relatively tight trading range.

The intraday market volatility has been extreme and it is very prone to news releases. This morning, news that China is diversifying away from the US dollar is weighing on prices. This is not a new piece of information. The two biggest holders of US dollars (Chinese and Saudis) have been stating this for more than six months. When you have a Fed that keeps pumping liquidity into the economy, you can expect the dollar to drop even further.

Eventually, a weak dollar will result in inflation as it costs us more to finance our trade imbalance. We already feel the impact every time we visit the gas pump. The good news is that demand for our products will increase since they are relatively inexpensive. Consequently, the employment picture will continue to be strong. The bad news is that we will have to spend more money to purchase the same goods.

China is not going to start to start dumping dollars. A weak currency makes us more competitive and China does not want to lose any of its global export business. China also relies on our consumption and a stable US economy is currently in their best interest.

Another news item that has been weighing on the market today is GM’s $39B write-down. This is not a cash write-down and that is why the stock is not getting trashed. In North America, auto sales lost $240 million. In the rest of the world, auto sales gained $120 million. The net effect was not that bad, but the write-down horrified investors. The big three auto companies are in disarray and weak results are expected.

All told, the market has been able to dodge bullets and it is still treading water near the all-time high. I feel that most of the bad news is already baked into earnings and the next round of positive news will generate a rally. The pessimism has been growing and there are more bears than ever. A breakout to new highs would force a great deal of short covering and that could fuel a year-end rally.

Financials, retail, restaurant and home builders have been trashed, yet the market has been able to find leadership in new areas.

As long as the support levels hold, stay long the market. If the SPY 149 level fails, get out of half of your long positions. If SPY 146 fails, get out of the rest of your long positions and stay in cash. I still believe that a buy the dip mentality is the way to go. If the market rallies back above 146, get back in to your long positions.

If you get short, you have a good chance of getting whip sawed at this level. It won't be safe to go short until a major breakdown occurs. We will also need to see prolonged selling and bona fide resistance levels.

For today, downside momentum has been established and it is likely that the market will close lower. We want to see the support levels hold. I don't believe there is enough good news to generate a reversal today. After the close we will get earnings from CSCO. A good number is expected and that might pave the way for a rally tomorrow.

Daily Bulletin Continues...