Tuesday’s Stock Option Trading Strategy!

Option trading should focus on selling out-of-the-money put credit spreads on strong stocks. If the market support levels hold, you can get more agressive and buy call stock options.

Last Friday, the bears tried to add to Thursday's big drop, however, by the end of the day prices had reversed and the market finished higher. The strong employment number confirmed the Fed’s notion that the economy is relatively strong outside of the housing sector.

Yesterday, the market had all of the ingredients needed to produce a big decline. Global markets were trading lower, massive subprime write-downs were revealed and instability in Pakistan could impact our war effort. The market was able to shoulder all of the bad news and by the end of the day the losses were contained.

This morning, the stock market opened on a positive note. Overseas markets were generally up and that provided a springboard. It seems that the focus is starting to shift away from the financial stocks and homebuilders. Apart from these two sectors, the earnings have been very good and more than half of the companies have reported. This week we should get a big number from CSCO and I expect the comments to be very optimistic.

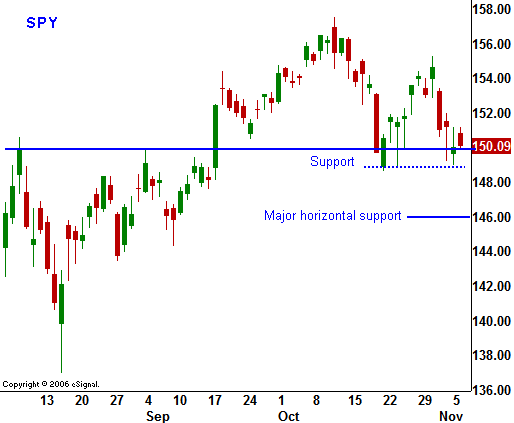

If you look at the chart you can see that we are right at a horizontal support level. The market has been able to bounce off of this level once before and if it does so again; it will become even more significant. You can also see that I have highlighted the SPY 146 level. That was the April breakout to new highs and it represents major horizontal support. You can also see that the market is within striking distance of a new high.

I believe that a strong seasonal pattern will push the markets to new highs. As we push higher, a short squeeze could be triggered at any time and the bears will once again be forced to run for cover.

As you know, I am expecting to see strength at any moment. Get long tech and commodity stocks as long as the outline support levels hold.

For today, the market seems rather subdued. I am expecting a gradual grind higher throughout the day. If we make a new intraday high, start adding to your long positions. If the market breaks below the SPY 149 support level, hold off and wait for strength.

Daily Bulletin Continues...