Thursday’s Option Trading Strategy – Lose Weight!

Option trading is influenced by the market. Rather than focus on specific stock options, I want to make a few statements today about the weak dollar.

Yesterday, the market hit an "air pocket". Concerns over a weak dollar created selling pressure. Over six months ago, our two largest financiers (China and Saudi Arabia) announced that they were going to diversify away from the US dollar. Their assets are very concentrated and they wanted to reduce their risk exposure.

The dollar has been under selling pressure for a number of years and it has reached 30 year lows against most major currencies. The latest round of selling was the result of the Fed's .75% interest-rate cut in the last two months. I still believe that we should have held rates firm and the subprime crisis needed to run its own course. The market would have sold off on a "no action" policy by the Fed, but we are experiencing that decline anyway. The rate cuts simply delayed the inevitable.

Capital markets are self correcting. Financial institutions have made a great deal of money during the last four years while credit was easy. Now they will have to give some of those profits back. In six months, when the losses can be assessed, the financial institutions will get back on their feet and they will return to profitability.

Unfortunately, analysts only want to see the market move higher. They don't want it to take a break and they certainly don't want to see it decline. These corrections are a natural occurrence and they keep the market from overheating. Markets that are artificially supported are vulnerable to very deep declines.

During the Fed Chairman's testimony, I heard many politicians asking for a "silver bullet solution". Obviously, there aren't any solutions that don't involve some pain and Ben Bernanke was smart enough to avoid answering the question. From my perspective, the bigger issue is that America is "fat". No one wants to admit it, but we are afraid to look in the mirror. I don't want to get too political, but this problem has been going on for decades.

We continue to spend more than we save. That is true on a federal, state, municipal and personal level. Debt levels are at all-time highs and no one wants to finance our piggish standard of life. We are somehow under the notion that we can continually spend our way out of a recession. Economists that point out the dangers of this behavior are often "thrown under the bus". Analysts are quick to point out that these concerns have been voiced for many decades and "we are still fine". This mentality reminds me of the cigarette smoker who is still standing after a 30 year habit. He may feel fine, but we all know it's just a matter of time.

I'm sure the Fed Chairman would love to tell the Senator to go back to his constituents/Congress and tell them to earn more and spend less. In the short run, our economy would go into a tailspin. Over time, we would be a much stronger nation. The answer lies within each of us.

Corporations are the only exception to the "spend more than you make" mentality. Balance sheets are stronger than ever and companies are buying back shares. As a result, the stock market has been able to hold its own during this period of volatility. We can all learn from their example.

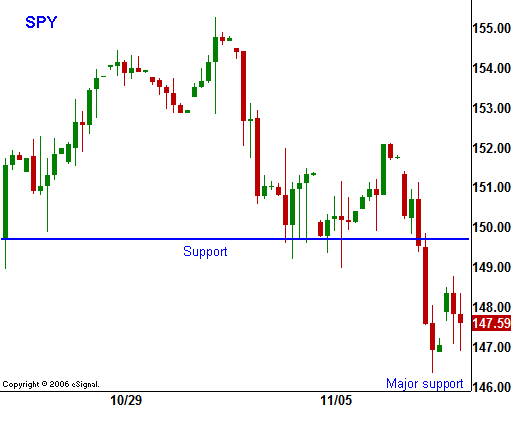

The Fed Chairman said that he sees deteriorating economic conditions and inflationary pressures ahead. That is called stagflation. It is the worst possible combination for the market. While this could spell trouble next year, I believe that the conditions will not change dramatically in the next two months. Seasonally, the market has entered a very bullish period. I am reluctant to short this market. I need to see a technical breakdown and a series of lower highs before I can feel comfortable with a bearish bias. If the SPY 146 level is broken, I will go to cash.

For today, extreme weakness yesterday and the failed bounce this morning translate into another tough day for the market. Downward momentum has been established and it is likely to continue. If the 146 level is breached, we are likely to test the lows from August. This is an excellent time to stay liquid and to conduct research. As I have mentioned, commodity stocks will be the play on the rebound. These are global resources and they are not exposed to a weak dollar. Global expansion is still strong and the US is the weakest global economic link.

Daily Bulletin Continues...