Daily Option Trading Strategy!

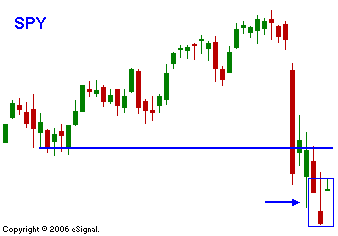

Last Friday nervous trading drove prices lower right into the close as traders reduced long positions. The overseas markets caught up Sunday night and they were down as much as 3%. When US markets opened Monday, the reaction was muted and stocks spent most of the day unchanged. During the last 15 minutes, a wave of selling pushed the S&P 500 10 points lower. Asian markets might have over reacted Sunday night and when prices rebounded Monday night, our market rallied on Tuesday's open. Here is how I read the price action. The Asian markets are probably where they should be in relation to the US markets. Last week's move was a wake up call to the fact that markets can go down. The move was fast and furious and I doubt that the average trader had much of a chance to take profits on long positions. I also doubt that bears had a chance to get short. The same is true of yesterday's drop 15 minutes before the close. My conclusion is that the bulls who want to reduce their risk exposure and the bears who want to short the market have yet to get their trades off. Today's rally simply negates yesterday's closing drop (blue box in the chart). Both events took place with the majority of participants on the sidelines. The fact remains that the average retail trader is over-margined. The market has changed its character in a week. Traders who were buying dips have put their wallets back in their pockets. Investors who were trying to milk the last penny out of the bull run are taking profits. As long as the SPY stays below 141 (blue line), I will remain short-term bearish. It will be interesting to see if the rally can hold going into the afternoon. Bearish markets open higher and close lower. That pattern is on its third day. Only a convincing close above SPY 141 will cause me to cover my shorts. Take your lead from the action this afternoon.

Daily Bulletin Continues...