Daily Option Trading Strategy

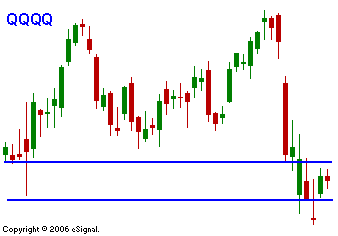

Yesterday the market rallied from an oversold condition. Retail traders are now convinced that it is ok to hang onto losing positions because they will come back. Their fortitude will be tested shortly. The fact remains that the character of this "never say die" market has changed and there's a kink in the armor. Last week's "air pocket" proves that the bid to the market is weakening and buyers are not as aggressive at this level as they were a few months ago. Global risk and liquidity are now in question. Here is how I see the day playing out. The bulls had a glorious day but the rally lacked volume and follow-through today. If the bulls can't take the market to a new intraday high by noon CDT, the bears will take a shot and they will try to drive the market lower into the close. The bears have a number of things going for them. SPY 140.50 represents horizontal resistance and SPY 141 is the 100-day MA. For today, this should cap the upside. Oil is up and the market faces a headwind. At 1:00 pm CDT, the Beige Book will be released. I believe it will show areas of economic weakness. That is an overlooked report because it is released late in the day and it might be a catalyst for an afternoon sell off. I am favoring the downside until the SPY closes above 141. Short stocks that fell last week and struggled to rally yesterday. They should also have broken support levels. That now represents resistance and it is where stops should be placed. The implied volatilities have come down after the rally Tuesday and I believe put buying is the best strategy as long as the IVs on the stock have not gone up more than 10% in the last week. The blue lines in the chart today represent short-term support and resistance levels.

Daily Bulletin Continues...