Daily Option Trading Strategy

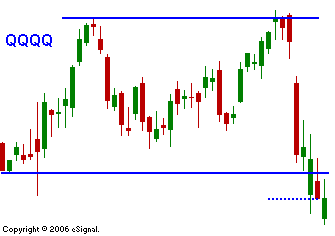

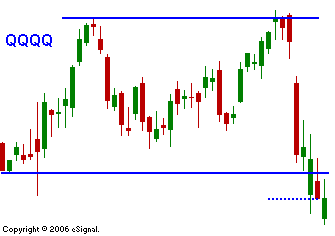

The tug-o-war is on and the bulls and the bears are battling it out. Last Friday we saw a bit more of a sell-off than was probably warranted. That's because some major damage had been done during the week and no one wanted to go home long. The overseas markets declined overnight in reaction to that drop. Many of the Asian markets were down 3% and the Yen was rallying. The fundamentals are the same as they were last week, but the sentiment has changed. We will be able to judge just how strong the bulls really are by how far they will be able to rally this market. At some point, profit takers and bears will apply pressure and an intermediate resistance level will form. I believe that we are due for a series of rallies and that each will set-up a shorting opportunity. The bulls that are over-leveraged have probably been able to sustain the first hit. The next move down will wash them out. From a bearish perspective, the rally this morning is exactly what they want to see. Once the rally loses its momentum, it will try the downside. Last May we had a two week period where the market rallied early and sold-off late. I believe we will see that pattern today and maybe all week if the selling does not get ahead of itself. From an option strategy standpoint, I would look for stocks that have had deep troughs last summer and have rallied back on the strength of the market. You might consider April at-the-money options or just out-of-the-money options. The trough should represent at least a 30% move in the stock. ERTS and MCO are good examples, but both have already run their course. I just used these to give you an idea of the chart patterns to look for. The deep trough tells you that the stock has uncertainty. If the stock's P/E is high, even better. The chart today shows the tech breakdown. Bears hope the QQQQ has trouble breaking above the old support level. The tech stocks have barely managed to get above Friday's close (blue dotted line).

Daily Bulletin Continues...