Daily Stock Option Trading Strategy

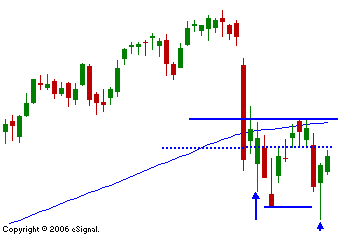

The market has shown its bid and the cliff-dive from last week is in the rearview mirror. I must admit, I'm surprised by the ease with which the market has recovered. Normally, when the "street" smells blood, it moves in for the kill. Retail traders are still over-leveraged and I suspect hedge funds are too. This snap back rally has taught retail traders that they can hold on to long positions and that the market will always come back. The next time they are confronted with this situation they will over stay their welcome. I'm short-term bearish (90 days) and intermediate-term bullish. For this scenario to play out, we need a washout. The "fluff" needs to come out of the market and the over-leveraged traders need to be shaken out. As this happens, the bears will have a chance to get short. At the trough of the move, the rebound will be even bigger than what we've witnessed this week. In fact, I believe the move this week is a microcosm of what we will see. The problem with the move during the last two weeks is that most of the action took place during non-market hours. There were a series of "air-pockets" on both sides. The "real deal" will come during market hours and it will last 4-6 weeks. For now, a warning shot has been fired. On the chart you can see the pivot point which was the close from last Wednesday. It represents a horizontal support/resistance level and the 100-day MA. If the market moves above it, I will move to a neutral bias and that means I will stay in cash. If the resistance holds and the market starts to back off, I will maintain a bearish bias. The retail figures today were decent but not good enough to justify the rally. The ECB raised interest rates 1/4 point today as expected and that creates upward pressure on our rates. Earnings guidance from most companies indicates slowing growth and I do not see a catalyst for an upside breakout.

Daily Bulletin Continues...