Stock Option Trading Strategy – Long commodity stocks and short consumer stocks.

Monday’s bounce erased most of Friday’s losses. Tuesday, the market started off on a positive note and it looked like the market would be able to grind its way higher. By late morning, additional news from the subprime group weighed on the market. The market reversed and it picked up momentum as it closed on its low of the day. The S&P 500 futures have been weak all morning and now our weakness has spread into overseas markets. Overnight, global markets were trading considerably lower.

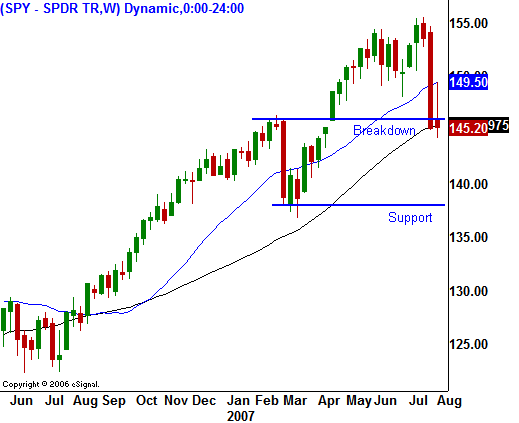

The critical SPY 146 level has been broken. That was a huge horizontal support level and it also represented the 200-day moving average. A move of this magnitude cannot be ignored. I’m trying to abandon my bullish bias, but I’m having a hard time doing so. Just a few weeks ago, Asset Managers were scrambling to find places to place money. A fast and furious 6 ½ percent decline has not lured them back into the market. Corporate earnings growth for this quarter is in the high single digits and that is way ahead of expectations. Interest rates have also pulled back from their high a month ago. I am seeing good value in many stocks and I’m expecting a snap back rally soon.

I feel we are close to a temporary low. The market will try to shakeout the remaining bulls and it will try to get a bigger commitment from the bears before it puts in a low. Yesterday’s reversal went a long way in accomplishing that. Bulls that ran in to buy the dip are regretting it. This morning’s decline below a key support level will attract many bears.

A large decline followed by an equally large rally will set the stage for a bounce. Once the rally appears, the market needs to follow through with two more positive days to get the snap back rally to unfold. Bulls will have their wallets out the bears will try to grab every offer as they run for cover. It’s easy to say that this time is different from February. It’s true that more technical damage has been done this time around, but apart from that, we can simply out some numbers to the damage. The subprime lending issues have been out there and without question the market discounted their importance. As the depth of this problem is identified, investors will regain their confidence.

Do not expect the market to jump up and immediately resume its trend. This information needs to be digested and it will take time. Expect a choppy market for the next two months. Your strategy is to buy stocks with relative strength and to sell short stocks with relative weakness. By maintaining a neutral bias, you won’t have to worry about the market. Be long commodity stocks and short consumer stocks.

Next week I will be on vacation and I will not be posting my daily market commentary. However, my Zero-in section will be updating and you can get many great ideas from it.

Daily Bulletin Continues...