Stock Option Trading Strategy – Long commodity stock and short consumer stocks.

The warning signs for this market decline were present will two weeks ago. Going in to option expiration stocks that had been leading the market higher failed to rally after posting solid earnings. The table was set for the market to feed off of expiration related buy programs as it made new all-time highs. When that failed to materialize, a red flag went up. Last week, the subprime debacle hit the headlines and traders piled through the exit doors. Credit risk went through a swift adjustment as the magnitude of the lending problem revealed itself. Reality came to roost and many of the market pundits have had their day in the light this week.

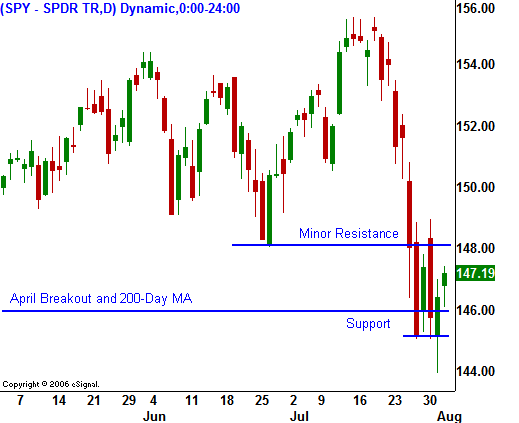

During the sell-off, serious technical damage occurred. The market was able to break below key support at SPY 146. That represents the 200-day moving average and the breakout from last April. I am finding it difficult to abandon my bullish bias and I still feel that this market has the potential for a year-end rally. I’m not expecting that the trend will resume for at least a couple of months.

This decline was much deeper than the one we saw in February and there was concrete evidence to support the move. During the decline a few months ago, the concerns turned out to be a legitimate, but there weren’t any casualties to point to. That said, I believe that on a short-term basis this might be a nice buying opportunity.

The market is very oversold and it needs good news to spark a bounce. This Friday, the Unemployment Report should provide just that. Every month this year, it has been able to generate a positive reaction. Employment has been strong and hourly wages are outpacing inflation. If the number is solid and the market can hold its gains going into Friday’s close, the stage will be set for “merger Monday”. Two consecutive positive days should be enough to shake the bears. This market has destroyed short sellers this year and they will be quick to cover on the next rally.

Overall, earnings growth rates are coming in at the high single digits and that is way ahead of expectations. Interest rates have managed to pull back during the last month and that is also bullish for equities. The U.S. is the weak link in the global picture. Our woes were barely enough to drag those markets down from their highs. Corporations that generate more than half of their revenues overseas are in great shape and there valuations are far stretched. Once the subprime lending problem runs its course, the market will resume its trend higher.

Until then, balance is the key. Buy stocks with relative strength and short stocks with relative weakness. This will help you reduce your market risk. The high option implied volatilities make this an ideal time to do put credit spreads on strong stocks and call credit spreads on weak stocks. I like being long commodity stocks and short consumer stocks at this juncture.

Daily Bulletin Continues...