Stock Option Trading Strategy – Long energy stock calls – Long retail and restaurant puts.

The market started off a bit tenuous yesterday. It was still trying to work off the prior week’s bearishness. Overseas markets rallied Sunday evening even after traders gauged our dismal performance on Friday’s close. Upon further review they decided that a weak housing market and careless lending practices were our problem. The strength in international markets came as a surprise especially after the Bank of China raised reserve requirements. It’s hard to imagine that the U.S. is the weakest link in the chain, but that’s the reality of it. The market tried to sell off a few times yesterday and then it finally gained some traction. By the end of the day, Friday’s losses had been erased.

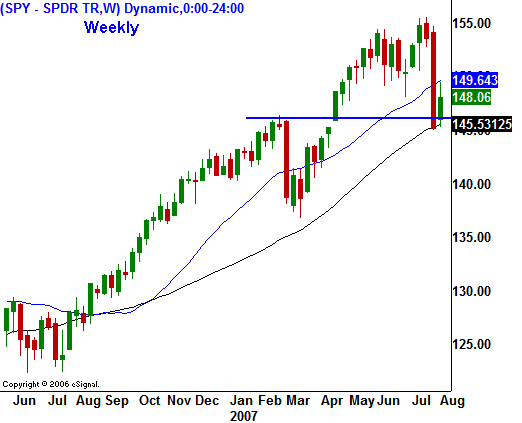

Today, the market started off strong and it looks like it will be able to add to yesterday’s gains. If you look at today’s chart you will see that the market was able to bounce off of major support at SPY 146. That was the breakout level from last April and it also represented the 200 day moving average. In the chart you can also see that the market is trying to get back above the 100 day moving average as well. Earnings have been coming in on track and interest rates have backed off a bit. These are bullish influences, but the biggest five-day decline in three years has to be respected. I am expecting a retest of the SPY 146 level sometime in the next few weeks.

All eyes will be fixed on the Unemployment Report Friday and it will swing the market one way or the other. If I had to take a guess, I believe the market will react positively just as it has every month this year. The employment component within today’s economic numbers was strong and I believe that will show up in Friday’s numbers as well. For today, look for a continued grind higher. I like being long energy stocks ahead of the oil inventories number tomorrow. I also like being short retail and restaurant stocks. Even with yesterday’s rally, these stocks were not able to recoup their losses from last Friday. Keep a balanced portfolio of longs and shorts and be prepared for continued volatility.

Daily Bulletin Continues...