Stock Option Trading Strategy – Sell put/call credit spreads on strong/weak stocks respectively.

If you trade long enough you will learn that sometimes your best trades are the ones that you don't do. Patience is one of the most difficult disciplines that you have to develop in order to be successful. Heading into last week's trading session, I could sense that the market had many issues that it needed to resolve. I expected a volatile week and I decided to take some time off to avoid being tempted by a headfake. My instincts paid off and now I can start with a fresh perspective.

Judging from the large intraday moves, the concerns still remain and it will take time for the market to gauge the depth of the lending problems. We are in "shoot first and ask questions later" mode and I believe the market will over exaggerate the magnitude of the lending issues. That will eventually set us up for a nice buying opportunity. There could be a great deal of pain before we reach that point.

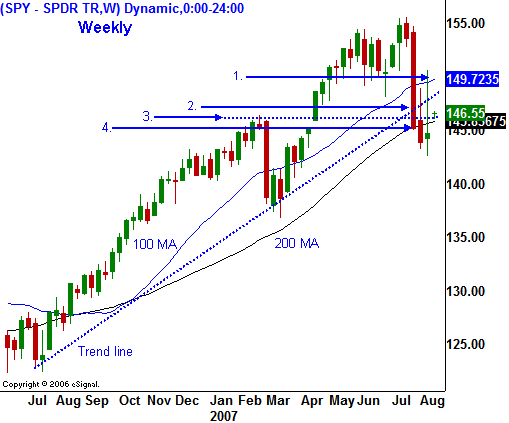

As you can see in the chart, there are four technical breaches that have taken place recently. First of all, we broke below the 100-day moving average. Then, we broke the uptrend line that dates back to last summer. Perhaps the most significant violation was the horizontal support level at SPY 146. That was the breakout from last April. Finally, you can see that the 200-day moving average was also violated. Even though the market is currently above two of those critical levels, this rally should be viewed with skepticism.

Last Friday, the market sold off after the close and the first 8 points of today's rally just gets the S&P 500 futures contract back to fair value. The VIX is elevated and the market is expecting large moves in the coming weeks. The put/call ratios are also on the rise. That is a negative indicator as long as they continue higher. The market has not been able to add to its early gains and I believe it will continue to chop around in a wide range today.

Today a decent retail sales number is helping the market. The only earnings worth mention this week are the retailers and Wal-Mart will release earnings Tuesday. I believe that weak results will show that consumers are tired and the market is likely to have a negative reaction Wednesday.

Tomorrow, the PPI will be released. A "hot" number would be devastating. It would mean the Fed is handcuffed and any easing is out of the question. In the past few months, the number has been benign and the market has been able to rally after breathing a sigh of relief. Consensus is a .2% increase and I'm expecting an in-line number. Later this week, the CPI, Industrial Production, Housing Starts, Philly Fed and Consumer Sentiment will be released. Any indication of a weakening economy or a rise in inflation could spell trouble for the market.

This is a good time to keep your positions small. You should be favoring out of the money credit spread strategies so that you can take advantage of time premium decay and a decline in implied volatility. The spreads will limit your risk and you can distance yourself from the action.

For today, expect volatility. I'm not going to try and guess where this crazy market is going to finish. For the rest of the week, I believe we will see a rally after the PPI tomorrow and weakness after the retailers announce earnings and the housing numbers come out later in the week.

Daily Bulletin Continues...