Stock Option Trading Strategy – Sell call credit spreads on retail stocks.

This morning the PPI came in hotter than expected and that is a negative development for the market. It means that the Fed will not ease to accommodate a tight credit market. The swift repricing of debt instruments is even impacting short-term commercial paper. Brokerage firms invest their excess cash in overnight repos and there are financial institutions that provide this service. In doing so, the brokerage firm is able to earn an extra .1% to .2% yield. Today one of the financial institutions that purchases commercial paper for brokerage firms pleaded with regulators to place a temporary halt on redemptions. If the firm liquidated enough commercial paper to satisfy the demands of brokerage firms, they would be dumping their holdings and a deep discount. Commodities accounts are not covered by SIPC insurance like securities accounts are. I suspect that people are pulling money out of of these accounts and the FCMs (futures commission merchants) are having to liquidate their overnight holdings to generate cash. This is similar to a "run on the bank". The ended result is that fear is creeping into the market.

As I mentioned yesterday, I suspected the retail sales numbers would be weak. Wal-Mart and Home Depot were already expected to post poor results but the actual news still created selling pressure. I believe that will be a recurring theme as the other retailers announce in the next few days. Later this week, housing starts are likely to sour the sentiment even more. If the CPI comes in hot we could see a full-blown sell off going into expiration Friday.

.

.

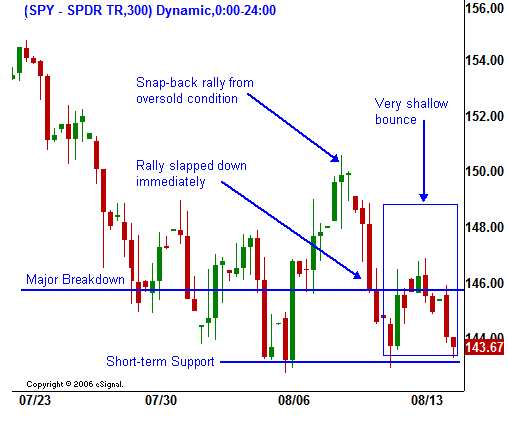

As you can see in the chart the trend for the last few weeks is down. The market broke major support at SPY 146 and it established minor support at 143. Last week it staged an oversold bounce. That move quickly lost its steam and the market was immediately slapped back down. That tells me that there is still a great deal of overhead resistance. The next bounce off of support was very shallow, indicating that sellers were even more aggressive than they were last week. We have tested a support level today and I feel that the 143 level will fail by the end of the week.

I suggest selling call credit spreads on consumer stocks with weak charts. I believe the market will sell off into the close today. The hot PPI, weak retail earnings and the Sentinel liquidity crunch will generate selling pressure.

.

As you can see in the chart the trend for the last few weeks is down. The market broke major support at SPY 146 and it established minor support at 143. Last week it staged an oversold bounce. That move quickly lost its steam and the market was immediately slapped back down. That tells me that there is still a great deal of overhead resistance. The next bounce off of support was very shallow, indicating that sellers were even more aggressive than they were last week. We have tested a support level today and I feel that the 143 level will fail by the end of the week.

I suggest selling call credit spreads on consumer stocks with weak charts. I believe the market will sell off into the close today. The hot PPI, weak retail earnings and the Sentinel liquidity crunch will generate selling pressure.

.

As you can see in the chart the trend for the last few weeks is down. The market broke major support at SPY 146 and it established minor support at 143. Last week it staged an oversold bounce. That move quickly lost its steam and the market was immediately slapped back down. That tells me that there is still a great deal of overhead resistance. The next bounce off of support was very shallow, indicating that sellers were even more aggressive than they were last week. We have tested a support level today and I feel that the 143 level will fail by the end of the week.

I suggest selling call credit spreads on consumer stocks with weak charts. I believe the market will sell off into the close today. The hot PPI, weak retail earnings and the Sentinel liquidity crunch will generate selling pressure.

.

As you can see in the chart the trend for the last few weeks is down. The market broke major support at SPY 146 and it established minor support at 143. Last week it staged an oversold bounce. That move quickly lost its steam and the market was immediately slapped back down. That tells me that there is still a great deal of overhead resistance. The next bounce off of support was very shallow, indicating that sellers were even more aggressive than they were last week. We have tested a support level today and I feel that the 143 level will fail by the end of the week.

I suggest selling call credit spreads on consumer stocks with weak charts. I believe the market will sell off into the close today. The hot PPI, weak retail earnings and the Sentinel liquidity crunch will generate selling pressure.Daily Bulletin Continues...