Stock Option Trading Strategy – Trade small and be balanced.

Today the Unemployment Report came in slightly lighter than expected and that was enough to draw the bears out again. There is nervousness going into the weekend and no one wants to go home long. It seems like the volatility is sky high, but if you take a step back, you can see that the intraday moves are creating that impression. The last five days, the SPY has generally traded within a 2 point range. That is actually mild compared to some of the moves we have seen in both directions over the last two months. I’m not candy coating this decline. Serious technical damage has been done and that will take time to repair. The market will take time to digest the lending issues and it will continue to adjust risk.

In the next two months, we can expect choppy trading. There will be opportunities on both sides of the market and it will be important to seek out stocks with relative strength and weakness.

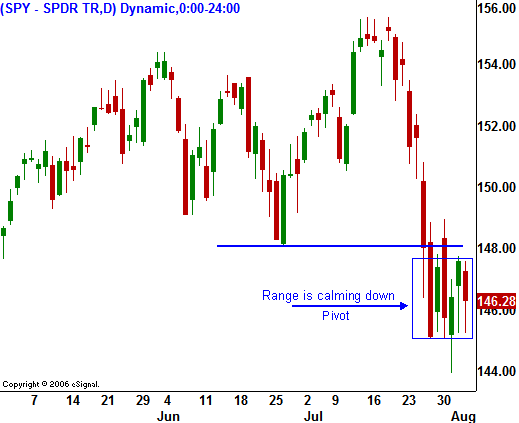

For today, watch for the SPY 146 level to hold. As you can see in the chart, this is a critical juncture. A failure would be bearish, a bounce would be bullish. If the market can stay above this level, it will bode well for next week. If this level fails and the market sells off into the close, it could spell more weakness next week.

Personally, I feel that the majority of the bad news has been priced in. If the bears can’t generate another big push lower, the bulls will start nibbling next week. Foreign markets have held up relatively well and they are knawing at the bit to move higher. I’m expecting the market to close right around SPY 146 today. The last 30 minutes will be very telling.

I am taking next week off to regroup and I will not be publishing daily market commentary. We will be very busy the rest of the year.

Trade small and be balanced.

Daily Bulletin Continues...