Stock Option Trading Strategy – Wait for a pullback and support before buying call options.

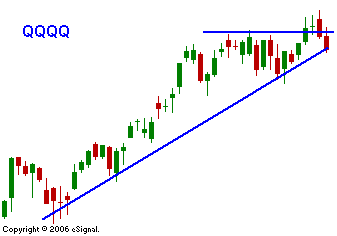

Today the market got two bullish pieces of information. Durable goods increased .6% in April, boosted by a 1.2% rise in capital expenditures. New home sales rose a greater than expected 16%. Both items should have been able to jettison the S&P 500 to record highs. After an early attempt, prices pulled back. There has been talk about Alan Greenspan's prediction of a "Chinese bubble". Any time assets increase at a parabolic rate, the likelihood of a correction exists. Traders have been fearful of this event and the February decline was a sampling of what's to come. The problem is that a melt up might happen first. After Mr. Greenspan gave his "irrational exuberance" speech in 1996, the NASDAQ more than tripled in three years. Once again, the economic releases have resulted in noise. The market is trying to make a new all-time high and as expected, there is resistance at this level. The old high was established seven years ago and long-term price levels are not easily breached. Quiet, choppy, holiday trading is likely to set in. The market is long overdue for a shakeout. I am hoping for a nice pull back so that I can start to purchase calls on stocks that I like. The heavy equipment stocks are very strong and there are a number of cyclical stocks I also like. I am still long energy stock call options and I believe higher oil prices are in store this summer. In today's chart you can see that tech stocks were not able to hold the breakout. They are very weak today even though business investments rose in April.

Daily Bulletin Continues...