Stock Option Trading Strategy – Long calls on energy stocks.

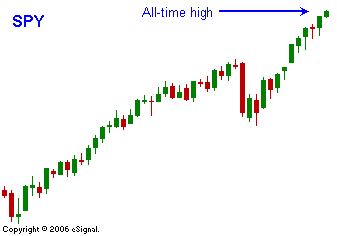

Breakout the party hats! The S&P 500 is trading at a new all-time high. It took seven years for this to happen so let's savor the moment. As long as companies have an earnings growth rate over 5% and long-term interest rates hold at this level, it makes sense to borrow money and buy profitable companies. That is the impact of liquidity. There is currently more money than opportunity. Large investors are looking for investments. The macro conditions are very favorable worldwide. Even if the US has an economic slow down, corporate profits will be buoyed by international revenues. Buybacks, private equity deals and M&A are reducing the number of shares outstanding and they are driving prices higher. Barring any catastrophic events, there doesn't seem to be any news that can phase this market. The parabolic run up in Chinese stocks will end some day, but that could be after another huge gain. That is the darkest cloud I can find and this market seems destined to move higher. I feel that a minor shakeout could come at any time. I would prefer to get long on that pullback. For now I feel safe buying calls on energy stocks. The market is likely to be choppy the rest of the day. The new highs have been established and now the market needs to close at this level. There is a good chance that we will rally into the close.

Daily Bulletin Continues...