Stock Option Trading Strategy – Long energy stock call options.

Last week, expiration related buy programs pushed the market to new multi-year highs. This week it tried to work off the hangover from that party. Going into the week the market was on the doorstep of a new all-time high. It has taken seven years for us to get back to this level and hearty resistance should be expected.

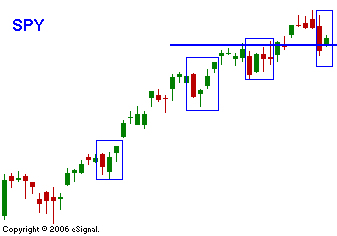

Once again, economic news proved to be nothing more than noise. Thursday, durable goods orders exceeded expectations and capital expenditures rose 1.2% in April. Housing starts were up a whopping 16%. That number was largely ignored and the consensus was that it would be revised downward. After an initial rally to new seven-year highs, the market reversed and closed on its low. Higher interest rates, a seven-year resistance level and a round of profit taking sent the S&P 500 down 16 points. There was a lack of buying interest going into the holiday weekend. Today, the market is bouncing and prices have firmed up. As you can see in today's chart that pattern has been very typical the last few months. Every big sell off has reversed in a matter of days, often the next day.

Holiday weekends tend to neutralize the two surrounding trading days and the activity drops off. Today, expect positive price action and quiet trading. I hope that yesterday's pullback was the start of something more meaningful. I would like to buy the next decent dip; however, it may not come. I still like the energy stocks and I am long call options. Even though they pulled back yesterday, they are snapping right back today.

I hope that you have a happy and safe holiday. Please take time to remember those who have served our country and made it what it is today.

Daily Bulletin Continues...