Daily Stock Option Trading Strategy!

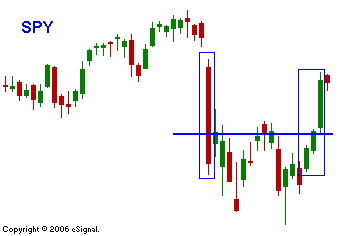

Big one day declines like the one we saw two weeks ago do not normally have happy endings like this. When the bears were humbled Monday, I had second thoughts about my short bias. Tuesday the bulls steam-rolled the bears for a second straight day and they could not generate a down tick. The closing move to the 141 level left me doubting the short side of the market and I closed some of my puts. By Wednesday’s FOMC meeting I was convinced the bulls would push the SPY through 141. Technical analysis is a great research tool and to a degree it is self-fulfilling. That level was a Fibonacci retracement, horizontal support/resistance and a 100-day moving average. All eyes were fixed on that level and the stops were layered “thick as thieves”. When the FOMC statement was released, it was like throwing gasoline onto a fire. The S&P 500 futures gapped up 10 points because of the buy imbalance. To make matters worse, no trader in their right mind sold futures into the breakout. There weren’t any offers and the market rocketed higher. We witnessed another “air pocket” where the majority of the volume actually took place at the extreme of the range. Before I sound too cocky I need to admit that I did not get long. I’m normally market neutral and it takes a lot for me to form a directional bias. When I do, I don’t flip flop around. I do not believe this is the same market we saw 3 weeks ago, yet the price levels are within striking distance of the high. In that time we have new information and the market has completely discounted all of it. Inflation is on the rise, sub prime loans are in default, the housing market has yet to bottom, global interest rates are on the rise, the Fed will not be easing, oil and gasoline are up big and corporate guidance tells us that earnings growth rates are declining. These are all new pieces of information. Another way to measure risk is to look at the implied volatility (IV) of the options. The VIX almost dropped to historical lows in 3 days. This tells me that traders are not hedging and that the events over the last two weeks mean nothing to them. If I sound bitter, I’m not. I’ve lost money over the last two weeks, but that is just part of trading. I still see trouble ahead and the next time around, I will be ready. For the time being, I’m trading from a neutral bias and I am primarily in cash. This market still has a chance to slingshot back to the old highs. The bears are licking their wounds and those that have not covered are doing so today. On the short side I like restaurants, discount retail, newspapers and on the long side I like energy and basic materials. Look for the market to grind higher today.

Daily Bulletin Continues...