Daily Stock Option Trading Strategy!

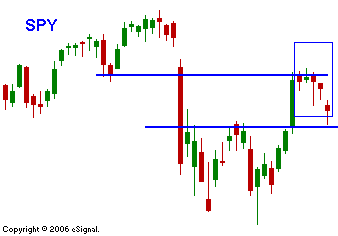

Ever watched a horror movie where the victim knocks out the villain only to see him come back to life? You just want them to strike the fatal blow while they have the upper hand. That's how I feel right now. The bears had the bulls on the run, but a flesh wound was all they could muster. If there were a good old fashion correction, I have a list of stocks I'd like to buy at lower levels. I believe there are deep seeded issues that need to be resolved and I will not turn bullish until a few things happen. First, I would like to see the SPY 141 level hold for at least a month. Second, I would like to gauge the impact of so called Liar Loans (aka "Alt-A" loans) as they convert from fixed to ARMs in the next month. Third, I want to see corporate earnings growth rates stabilize. Earnings are growing, but at a slower rate. The market drop that we have seen the last two weeks seems to be nothing more than a warning shot. I have included some arrows in the chart that help to explain my rationale. The big down day is very visible and to the right of it you can see the first arrow. The market made an intraday low and snapped back before the close. The next arrow is actually quite constructive. The market makes a new relative low and it closes near the low of the day. However, if you look at the next trading day (3rd arrow) you will see a snap back rally. The forth arrow shows a big intraday drop and another snap back rally by the close. My conclusion is that the bears simply can't destroy the "bid" to the market. Since the last decline, the bulls have regained their confidence and they know that a push above SPY 141 will create buying pressure. To add fuel to that fire, most of the other markets are on the rebound as well, and the Chinese market is back to all-time highs. If this market decline were the real deal, we would have seen a number of down days in a row, and there would have been lower relative lows and lower relative highs. This head fake has cost me money, but my psyche is intact. I know that a clear perspective will help me identify the next opportunity and I'll make my money back. As for today, I'm not expecting anything new from the Fed. The market has the momentum it needs to move higher and a non-event will be spun in favor of the bulls. I'm prepared to sell my puts and go to cash for a while if that scenario plays out. It will be "dead till the Fed" and you should take your lead from the SPY 141 level.

Daily Bulletin Continues...