Daily Stock Option Trading Strategy

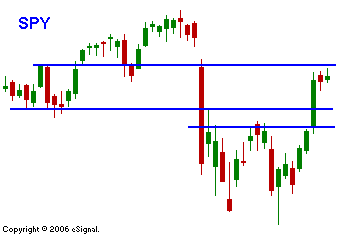

The market is trying to add to the huge gains from this week. I'm sure we are still seeing some short covering spill over. I expect to see the market challenge the old highs, but I doubt it will breakout in the next two months. For it to make new multi-year highs (with follow through) we need to gauge the next quarter’s earnings and we need a slowdown in inflation. Lower oil prices would be a great start. As I’ve stated, I’m market neutral at this level and I won’t get bullish until time has passed and the recent decline can truly be considered a hiccup. The VIX almost dropped to historical lows Wednesday and I’m surprised that the market discounted risk so quickly. The IVs picked up a bit yesterday and it might signify hedging. Contrarians are jumping on the extreme put/call ratios and they are saying that this indicates excessive bearishness by option traders. I don’t see it that way. Bearish retail put buying would result in higher, not lower IVs. There is much more selling taking place than buying and most retail traders do not short options for risk, margin and brokerage account approval reasons. Besides, margin debt is still at the levels seen in 2000. Incidentally, the put/call ratios were very high back then too. I believe the retail trader was not shaken out and they are as bullish as ever. They have been right so far and I congratulate them. For today, look for a continued grind higher. The bears don’t want to stand in the way and it would be foolish to go into “Merger Monday” short. I have drawn some horizontal support and resistance lines in the chart. If they hold, it signifies a range. If they are breached, it signifies a new leg to the move. I like energy and basic materials and I’m short restaurants, newspapers and specific retailers. Biotech has also been very weak but that is a dangerous arena.

Daily Bulletin Continues...