Daily Stock Option Trading Strategy

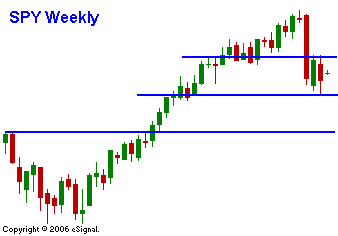

Today's action seems rather subdued and I suspect it is the calm before the storm. The bulls and the bears have drawn a line in the sand at SPY 141. That level represents a Fibonacci retracement, it is the 100-day MA and it is a horizontal support/resistance line. The winner of this battle is likely to control prices for the next month. Overseas markets were positive and it looked like the market would follow-through on Friday's late day rally. The sub-prime lenders released more bad news today and the market continues to dismiss the impact on other lenders. There are a number of items that will drive prices this week. This is a quadruple witch and that usually means that there will be one or two volatile days as traders roll their positions. In December, GS, LEH and BSC sparked a big rally going into expiration when they blew their numbers away. Financial stocks make up 20% of the S&P 500 and they could swing the market either way. GS announces tomorrow and they do not have sub-prime exposure. Wednesday and Thursday LEH and BSC announce respectively. Thursday and Friday the PPI and CPI will be released. Those numbers will be closely watched. The bulls are still expecting to see a rate cut in July and higher inflation will dash those hopes. I am short-term bearish and I feel the lows from last Monday will be tested. If the market continues to fade, I will join in. The implied volatilities dropped during last week's rally and they are relatively cheap given the elevated risk levels. As a result, I am a put buyer. If the market rallies above SPY 141, I will exit my put positions and go to cash. The market is transitioning and I do not want to get chopped up. Gradually, over the next month I will build long and short positions if SPY 141 holds. I will not turn bullish until the market shows that it can move higher over the next few months. There is a greater chance that the market will test the downside today and a close below SPY 139 would be bearish.

Daily Bulletin Continues...