Daily Option Trading Strategy

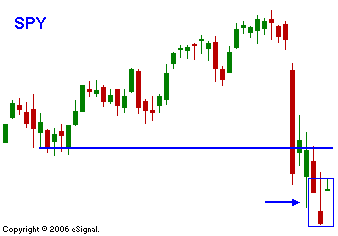

This is an early post. The big overnight move in China will rattle many people when they turn on their screens today. We are overdue for a 3% correction so today's drop should not come as a surprise. It's what happens after the open that is important. Will it be a dip to buy? Is this the beginning of the retracement? Only time will tell. On days like this I like to watch the price action. I will be focusing the support levels. If the market blows right through SPY 143.50, it will not bode well for the action the rest of the week. If the market tries the downside early and rallies late, there is still a good bid to the market. I have been favoring put credit spreads and while they may take some heat, it's not the end of the world. If the market closes below SPY 143.50, I will buy some of them in. I have also been buying calls on the dips. This time around I will take a pass. We are entering a seasonally weak period of the year for tech stocks and the financial stocks are showing signs of weakness. I would be a call buyer if the market tests SPY 141 and finds a big bid. Reporters are sensationalizing the "huge" 9% drop in China. Folks, their market is up 13% in the last 6 trading sessions. Even with the drop they are still higher than they were 7 days ago. I'm not saying to discount the drop, let's just keep it in perspective. If you are really nervous this morning, you are over exposed - lighten up your longs. Personally, I try to maintain a hedged position and I will enjoy the activity like I enjoy a summer storm. big moves present opportunity. If you are looking for shorts, go take a look at the Live Update page of the Daily Report. It is free today during the open house. It is a ready made list of strong and weak stocks. This should not be a day of active trading unless you are reducing your bullish positions. Watch the action and try to assess the selling pressure.

Daily Bulletin Continues...