Daily Option Trading Strategy

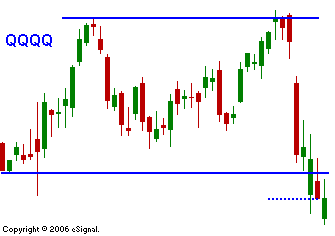

Before the open the market looked like it was ready to take off. After the first 15 minutes of trading it gave everything back. "Merger Monday" was fueled by TXU and DOW today. Once the excitement wore off, the rally faded. There isn't any news to drive this market (one way or the other). Profits are strong, unemployment is low, productivity is rising, the S&P 500 P/Es are fair, interest rates are relatively low, inflation is in check.... I don't see any reason for this market to have a sharp decline. If it does, it will be a round of profit taking as opposed to short sellers. Bears have been beaten badly over the last 4 months an no one is going to short this market until a major technical support level is broken. Some traders are pointing out that debit margin levels are nearing those seen in 2000. That in and of itself won't cause the sell off. It is not a healthy condition, but something major needs to happen to start the decline. One could also argue that the large debit balances mean that the retail trader has used up their firepower. This is true to a degree; however, there is so much global liquidity that it is not an issue at this stage. You don't have to look any further than the corporations for proof. They are buying back shares at record rates. For today, look for a drift lower. That tone has been set. I have been selling put spreads on stocks I like and if I get a dip down to a support level, I have been buying calls. When the market rallies, you have to take profits quickly on the calls. There is little follow through. In the chart today you can see that the tech stocks have been caught in a range since last November. They are trying to breakout and they need to for this market to make a sustained move higher.

Daily Bulletin Continues...