Daily Option Trading Strategy

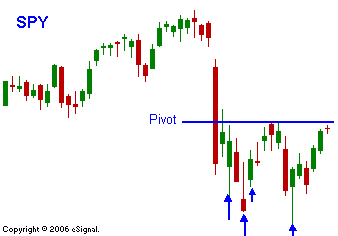

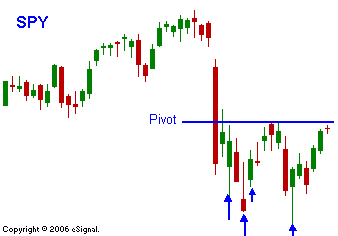

Fear has replaced greed in a single day. All of the fundamentals are still in place, but technical and psychological damage has been done. Those that were hanging on to long positions in hopes of additional profits are now selling. The Risk Managers at brokerage firms know the problem accounts and they are on high alert. Margin debt as a percentage of the account is at levels seen in 2000. There is an abundance of leverage everywhere and I suspect that a hedge fund... or three will fail. The emerging markets have been soaring and the liquidity is poor. If investors take profits in that highly speculative arena, the sell off could be nasty. P/E ratios and interest rates are still favorable for a market rally and there is not nearly as much froth as we saw in 2000. If the market can't add to the gains and make a new high after noon central time, the downside will be tested. Traders smell blood and the fact that we have not tested the "bid" to this market today is a bit surprising. SPY 141 is a multiple support level. If we close below it, lower prices lie ahead. I will look to get short if the rally fails. This strategy will only last today and I will be taking it day-to-day from here. The VIX has dropped and by any historical measure, it is still cheap.

Daily Bulletin Continues...