Daily Option Trading Strategy

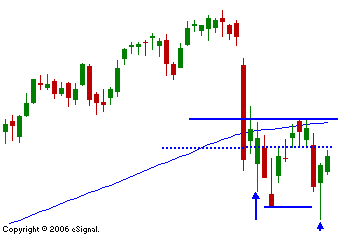

The easy money has been made in this market. There is very little follow through and the market takes two steps higher and one step back. Earnings are behind us, the FOMC won't meet for a while and the inflation numbers have been released. There won't be any catalysts and that spell higher prices. The SPY has broken out and the tech stocks are on the verge of doing so. Cyclical stocks and commodity (basic materials) stocks are leading the way with tech showing signs of life. As you can see in the chart, the best way to play this market is to buy the dips. They are designated by the blue boxes. My strategy has been to sell put spreads on the breakouts so that I have some "cushion" if the market pulls back. On the dips I've been a call buyer. I also have a safety net contingency order working. If the QQQQs trade below $43.50 I will buy puts to hedge my longs. I'm not expecting that to happen in the near future given the strength of the market and the lack of "dark clouds". As the market keeps rallying that safety net will be moved up with the rising trend line. For the rest of the day, expect the market to stay within the range. If a new daily low is made after 1:00 pm CDT, there is a chance for additional selling into the close.

Daily Bulletin Continues...