Daily Option Strategy

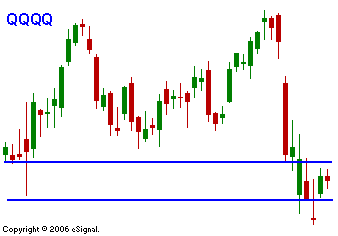

This "never say die" market just keeps grinding higher. It has been able to shrug off any negative news and that condition will prevail until a negative catalyst materializes. Earnings are robust, the economy is solid, unemployment is low and inflation is in check. Interest rates are at a historically low level, the P/E of the S&P 500 is under 16 (with a 1.7% dividend yield) and the real estate market is soft. Equities offer the best risk/reward. If you take your lead from large corporations, they are buying back shares at an unprecedented rate. I expect this market to continue higher until interest rate move higher or earnings falter. We are due for a 2-3% pullback, but trying to time that has been a losing proposition. In the grand scheme of things, that decline will be a blip on the radar and it will set-up a buying opportunity. As we breakout, I would focus on put credit spreads. That will allow you to distance yourself from the action as the market is in a two-steps-forward/one-step-backwards mode. The market is likely to grind higher this afternoon. The bears had their chance this morning and failed. Today's chart shows that tech stocks are about to breakout.

Daily Bulletin Continues...