Daily Option Trading Strategy

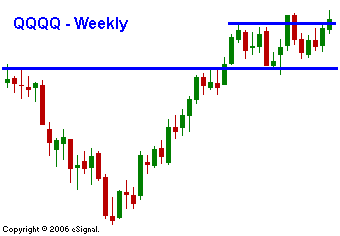

It is easy to get caught up in the moment when you are trading. That usually happens when you have a large position or a portfolio that is bias toward one market direction or the other. Most people are VERY bullishly weighted and the margin debits as a percentage of account value are higher than they were in 2000. That's scary. Without question, we are due for a 2-3% pullback. A move like that would wipe out speculators that are over-leveraged and it would not even register a blip on a 5-year chart years from now. The bullish speculators need to be shaken out of the market before it can move higher at a good clip. A 3% move would also attract bearish attention and that creates a short squeeze opportunity. Until we get the pullback, the market will chop higher. I believe the only way to trade it is to credit spread while we are in the range and maintain a bullish bias. That will distance you from the day-to-day noise. If we get a decent pullback to support, consider a long call position. Here are some key support levels: SPY 144 is a long term trend line that dates back to July, SPY 143 is a horizontal support level that represents the December breakout, SPY 140.50 is the 100-day moving average. As long as those levels stay intact, stay long. As they fall one-by-one, reduce your longs. I used the weekly QQQQ chart today to show that the tech stocks are in a tight range and they are trying to break out. If they are able to, the rest of the market might catch a "second wind".

Daily Bulletin Continues...