Daily Stock Option Trading Strategy!

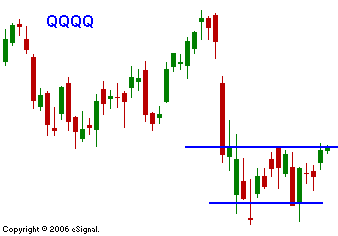

The market staged an impressive rally yesterday on the back of strength overseas. From the onset, stocks looked like they were going to grind higher and they did. That was a major victory for the bulls since the bears could not even put a dent into the price action. As a result, we have inched closer to the critical SPY 141 level. The bulls will take comfort knowing that the relative lows were tested last week and they held. After a big run up, the bulls will normally take a breather the next day. No one wants to buy a top, so they will not be overly aggressive until they know the "coast is clear". The bears will be able to try their hand early the next day and if they can get things going, the bulls will wait patiently. If the bears can't stimulate a round of profit taking, the bulls will step up and resume the rally. That is the juncture we are at and I sense that the bears are ready to throw in the towel. The rallies have not had the same volume as the sell offs, but if we break SPY 141, that will change as the bears get stopped out and the bulls rush in. I am bearish and I have my finger on the trigger to close down my long put trades on a convincing close above 141 with follow-through. I'm willing to go to cash and wait this out. I see warning signs and this is not the same market we saw a month ago. The Fed is likely to keep their comments the same and that will probably be neutral for the market. They know the dangers of a housing slowdown and inflation and they don't want to over-emphasize either. I feel we will see a rally close to 141 today. What happens then will determine prices for at least the next month. If the bulls can push the market through, we will see a big push higher (possibly to the old high) as shorts run for cover. If the bears are able to step in and slap the market down, the 141 resistance may hold and the bears might be able to swing the momentum back their way. Today's chart shows that the tech stocks are on the verge of making a new relative high (blue line). That is also bullish.

Daily Bulletin Continues...