Daily Stock Option Trading Strategy

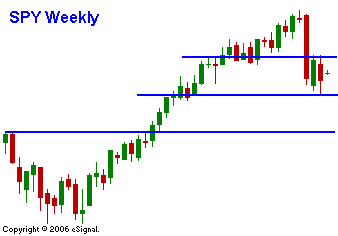

"Merger Monday" and a global rally will test the bears today. The S&P 500 opened 10 points higher and it needs to make an assault on the SPY 141 level this week to shake the confidence of the bears. Everyday that the market trades below that critical level, the resistance builds. Last week, we saw very "hot" inflation numbers and we saw a drop in consumer confidence. The market was able to avoid a drop even though the chances of a Fed ease in July are diminished. Bulls are still hoping for some positive news from the FOMC meeting this week, but that is unlikely. The housing sector continues to show weakness and over the next few days additional data will be released. This segment of our economy will have to work its own way out of the cycle. Global interest rates are on the rise and over the weekend, China raised rates 1/4 point. That puts upward pressure on our rates as investors sell US Treasuries in favor of more attractive foreign debt. From my standpoint, there are a few things that are keeping me bearish. On a technical basis, the SPY has broken a trend line, horizontal support and the 100-day moving average. I also feel that seasonal trends are happening earlier as more traders follow them. Remember the October 2006 rally that started in September? "Sell in May and go away" might start in April. From a fundamental standpoint, earnings and interest rates are the key to a market rally. I've already discussed interest rates, what about earnings? The guidance from last quarter is indicating that earnings growth rates for next quarter will slow to single digits. The financials have been fueling the market rally, but even solid numbers from GS, LEH and BSC could not get the sector moving last week. This market lacks a catalyst. If the market closes handily above SPY 141, I will shift to a neutral bias. I still feel that there are too many headwinds and that the bullish speculators need to be shaken out. I am long puts and I will continue to hold them as long as the SPY stays below 142. I feel there are good shorting opportunities in the retail and restaurant groups. Higher gasoline prices will bite into discretionary spending. The chart shows 3 critical levels. If the SPY closes above the top line, I will sell my puts and go to cash. If it breaches the middle line I will add to my put positions, as it approaches the lower line I will take profits on my shorts. As for today, the market has a good head of steam today and I feel it will grind higher. It will try to test SPY 140.50. I do not think we will see an afternoon reversal today, although that would be a major victory for the bears.

Daily Bulletin Continues...