Stock Option Trading Strategy – Energy, heavy equipment, mining call options.

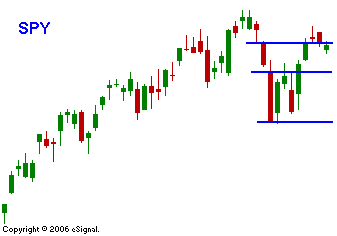

As I mentioned yesterday, the market is still working off its expiration hangover. The market recovered nicely last week and it filled in the down gap that followed the prior all-time high. That gap represented minor support and it is the top blue line in the chart. I'm not overly concerned with the breakdown. Today the market is reacting to weaker than expected numbers posted by BBY. There is a lack of news this week and I believe that the FedEx earnings release tomorrow before the open could move the market. That company is used to gauge economic activity. This is a 5-week expiration cycle and I have found that the first week tends to be very lackluster. I still like to reference the big down day from Thursday (two weeks ago) and I want to use that range as a guide. On a very short-term basis, the market needs to stay above the middle blue line in the chart to remain bullish. If the market breaks below the lower blue line, there is a good chance we will test SPY 146. I expect a relatively quiet week with a chance for prices to move lower. That will set us up for the next snap back rally and it will take us to new highs. Energy, heavy equipment, and mining are the places to own calls.

Daily Bulletin Continues...