Stock Option Trading Strategy – Long mining and heavy equipment calls, selling energy calls.

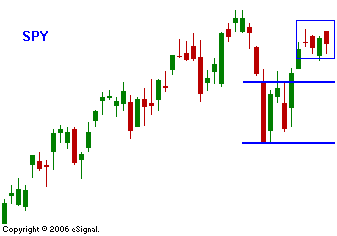

For those of you trading this market, it's a good day to catch a movie or play a round of golf. Over the last few days the market has fallen into a quiet summer trading pattern. In the absence of news, the market lacks direction. I was hoping that FedEx would provide some fireworks either way. The company said that a soft U.S. economy is limiting demand for transportation services. Traders had already factored that into the share price and the stock is up $2. The market took the comments in stride. European markets were up overnight and that buying failed to spillover into our market. Energy stocks are down a bit today on the oil inventory release. There was an unexpected large build in inventories and I am taking profits on energy stocks. If they pull back, I will wait for support and re-enter. I am long term bullish on the sector. I still believe there is a chance for the market to drift lower this week. Interest rates are starting to creep higher again. Look for prices to drift lower today. In the chart you can see that I am still using the daily range from Thursday’s large drop two weeks ago as a gauge. As long as we stay above the upper blue line, there is a chance that the market can stage an assault on the all-time high.

Daily Bulletin Continues...