Stock Option Trading Strategy – Long energy, metal mining, heavy equipment call options.

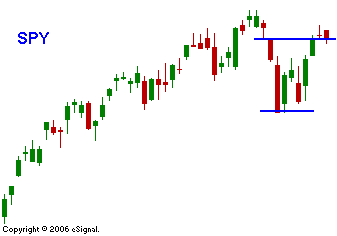

Last week the market dispelled the notion that a correction was about to take place. The market had another one of its signature snap back rallies and we are within striking distance of an all-time high. Evidence of economic growth and contained inflation negated a rise in interest rates. Option expiration buy programs helped to lift the market and now we are nursing a hangover from last week's party. This week we will see if the housing market has a pulse. I can't imagine that any news from this sector can weigh on the market. All of the negative news has already been factored in and I believe only a positive market influence can come from the housing releases. Later this week, FedEx will release its earnings. They will be scrutinized and conclusions will be made about the strength of our domestic economy. I believe we will see a quiet market today and the range will be established in the first two hours of trading. Focus on energy, heavy equipment, and metal mining stocks. I continue to hold long call positions in those areas.

Daily Bulletin Continues...