Daily Stock Option Trading Strategy

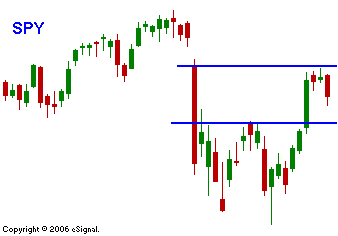

The big drop that we saw in February was caused by uncertainty and now traders feel they have been able to quantify those risks. The 9% drop in the Chinese market was profit taking and now it is back to all-time highs. The sub-prime loan crisis is “contained” and the extent of the losses has been calculated. Inflation is on the rise, but the Fed removed references to tightening. Apparently, this was just a giant hiccup and there is nothing to worry about. I’m fairly skeptical on all of the points. Chinese investors are bidding stocks up while their government is tightening credit. They are known to be huge gamblers, the valuations are stretched and they have yet to experience a major market decline. The sub-prime loan defaults might be known, but there are a large number of Alt-A loans (Liar Loans) that convert from low fixed rates to ARMS in the next month. Inflation is on the rise and I believe that the Fed changed its rhetoric because it has concerns about economic growth. I don’t like to bring up the “S” word (stagflation) but it needs to be considered. Next week Durable Goods, GDP, Core PCE and the Chicago PMI will help us gauge inflation and the strength of the economy. The only earnings release of interest next week is TIF on Monday. I expect to see the market challenge the old highs, but I doubt it will breakout in the next two months. For it to make new multi-year highs (with follow through) we need to gauge the next quarter’s earnings and we need a slowdown in inflation. Lower oil prices would be a great start. As I’ve stated, I’m market neutral at this level and I won’t get bullish until time has passed and the recent decline can truly be considered a hiccup. The VIX almost dropped to historical lows Wednesday and I’m surprised that the market discounted risk so quickly. The IVs picked up a bit Thursday and it might signify hedging. Today, the VIX is up 1.5 points. Contrarians are jumping on the extreme put/call ratios and they are saying that this indicates excessive bearishness by option traders. I don’t see it that way. Bearish retail put buying would result in higher, not lower IVs. There is much more option selling taking place than buying. Margin debt is still at the levels seen in March of 2000 and I believe the retail trader is as bullish as ever. Incidentally, the put/call ratios were very high back then too. They have been right so far and I congratulate them. For this week, the market looks like it might test the SPY 141 level before it tries the upside again. If it drifts lower and finds a big bid before it can hit 141, there is a chance for a nice rally to the high. IRA and 401K money will still be finding its way into the market for the next few weeks. The end of the month is approaching and if that money gets "placed" it will lend support to the market. If the market tests SPY 141 and fails, I expect a more controlled. sustained decline. That would damage the psyche of the bulls. As long as SPY 141 holds, I'm neutral and looking for credit spreads on both sides of the market.

Daily Bulletin Continues...