Stock Option Trading Strategy – Long energy and heavy equipment call options.

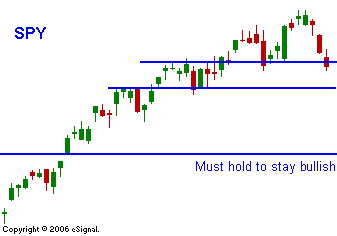

Yesterday was one of the weakest days we've seen in months. The market opened lower and it continued to decline throughout the day. There were a couple of failed attempts to rally prices. In the last 15 minutes of trading, the sellers showed up in force. Before the open today it looked like prices might firm up. However, that bounce quickly disappeared and the downside was tested. The A/D ratio is a negative 1:4 and that will be tough for the market to overcome. Retail sales figures did little to excite traders and it looks like prices will move lower until buyers establish a "bid" to the market. As I've been mentioning, the table is set for a decline this week. This is a good time to keep your positions small. The SPY is still two points away from testing minor support at $149.50 and that could happen tomorrow. Next week holds the key. If overseas markets are strong coming out of the weekend and merger Monday produces some buying, there is a chance that the bulls will rally the market. That rally could be further fueled by option expiration program trading. If the market can't find sound footing, there is a good chance that there is another leg to this decline. Either way, it is wise to step aside and use this time to find stocks that are holding up relatively well. Energy and heavy equipment are still two of my favorite areas and I believe global economic expansion will support those stocks. Companies that derive their revenues solely in the United States pose the most risk since our economy is lagging. As long as SPY 146 holds, maintain a "buy the dip" mentality - but wait for the support to establish itself.

Daily Bulletin Continues...