Stock Option Trading Strategy – Wait for support to be established and then buy calls.

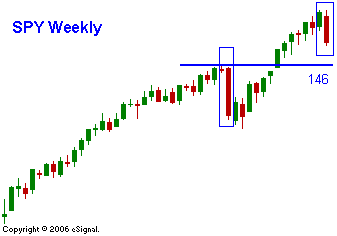

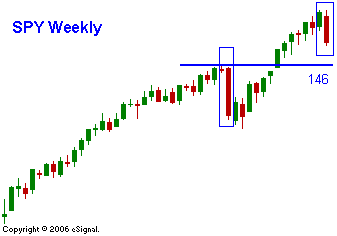

This has been a bloody week and I suspected that we were in trouble Monday when the market completely discounted the 10% drop in the Shanghai Index. Given yesterday's decline I thought I would try to give you a very early read on the market. On a short-term basis it is likely that we will have a bounce on the open and that the downside will be tested. If buyers are able to establish a bid by midday, there is a good chance we will finish the day to the upside. If traders are nervous going into the weekend and they can push prices lower, next week could get off to an ugly start. The S&P 500 is 40 points from a major support level at 146. I believe that level will hold. Interest rates might be creeping up, but they are still near the low end of the 50-year range. Rates are not increasing because of inflation; they are rising because of global economic expansion. A positively sloped yield curve is good for the market and this rise will correct the current inversion. Corporate earnings have seen double-digit growth for 14 consecutive quarters. As a result, their balance sheets are strong and they are using cash to buy back shares or acquire companies. Even last quarter was considered to be weak and earnings rose a healthy 6%. As you can see in the chart, over the last year the market has established a pattern of sharp declines that follow relative highs. The corrections are very short and steep and the recoveries are brisk. I do not see any evidence that the macro environment is changing. I do feel that many analysts have had to raise their interest rate expectations. None are more significant than Pimco’s Bill Gross. He has been leading the charge for lower rates and he manages the largest bond fund in the world. This adjustment process creates chaos. I believe the market will get a custom to the "tight light" bias and it will put the relatively low interest rate picture back into perspective. Employment is strong and wages are increasing due to a tight labor market. Companies are profitable and the P/E ratios are reasonable. Inflation is relatively contained. Given these factors I do not see a doomsday scenario unfolding. I do see a market that needs to work off some excess and this is not something to stand in front off. Let the market establish its lows and once prices firm up, "by the dip”. By now you know my two favorite areas are energy and heavy equipment. I want to add to those positions and I want to make sure the lows for the market are in. For more conservative traders, consider put credit spreads.

Daily Bulletin Continues...