Stock Option Trading Strategy – Long energy and heavy equipment stock call options.

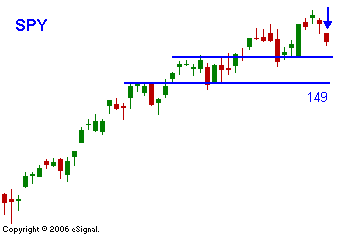

This week was set up perfectly for a pullback. There was a lack of news (earnings and economic releases) and the market was prone to abstract influences. Traders completely dismissed the 15% decline in China and I viewed that as a warning shot. Interest rates have been steadily climbing higher for months and after Chairman Bernanke’s comments, they were pushed to "center stage". This is a macro event. The market can take either of two paths and I believe we will know next week. This week, I see a continued decline perhaps down to the SPY 149 level. I believe that traders have grown accustomed to buying these big dips and they will rush in to try and pick a low. That rally will fade and the market will test the downside. That pattern has become a little too predictable and I don't believe it will work this time because interest rates have moved up. This morning England raised its rates by a quarter of a point in that was widely expected. Down gaps that follow a relative high need to be respected. In today's chart and you can see that down gaps have largely been absent from trading over the last few months. Next week will be pivotal. Expiration week has been bullish. If the market can stop the bleeding, there is a good chance that this week's loss will be erased. If the market can't rally, there is a good chance that the SPY 146 level will be tested. Either scenario can play out. I believe that higher interest rates will ultimately be accepted by the market. They are on the rise due to global and domestic economic expansion and inflation is contained. The rise in long-term interest rates will result in an upward sloping yield curve and that is a bullish indicator. Companies are still flush with cash and their balance sheets are very strong. Stock buybacks, M&A, and private equity deals will continue to support the market. Be prepared to "buy the dip" and use next week's price action as your guide. For now, take profits on long positions and don't try to short this move. I am still long calls on energy stocks and I am long a handful of calls on heavy equipment manufactures. I will add to the latter once the market finds support.

Daily Bulletin Continues...