Stock Option Trading Strategy – Long energy, heavy equipment and mining stock call options.

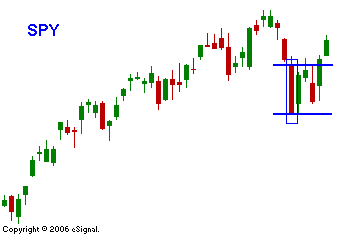

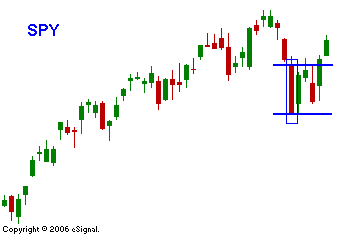

It didn't take long for the market to adjust to higher interest rates. In the last few days most of the losses have been erased and the market is forging its way higher again. The 10-year rate has backed off a little this week and that is helping. As I've been mentioning, option expiration has a very positive bias. I did not expect yesterday's rally at the time I wrote my daily comments. However, I have been saying that if the bulls can get a sustained directional move, the programs would "goose" the market. In afternoon trading, the Beige Book was released by the Fed. It is released every six weeks and it recaps economic activity throughout the country. It showed a growing economy and moderate inflation. Once traders latched on to that information they rallied the market and squeezed the shorts. Today we are seeing follow through on the "in-line" PPI number. Excluding food and energy, the core rate came in at .2%. The market was comfortable with the number and it has rallied. The CPI is due out tomorrow before the open. That could provide some extra fuel for the market. I am not expecting that number to contradict today's inflation number. I mentioned in my report yesterday that you should use last Thursday's open and close as a guideline. Yesterday the market rallied above that range and it was a short-term opportunity to get long. As long as interest rates stay at his general level the market seems comfortable. I am long calls in energy, heavy equipment and mining stocks. These groups are strong and they have held up well during recent declines. The market has made a very large move in the last few days and it should hit resistance this afternoon. Much of the option activity took place yesterday and that impetus will be missing.

Daily Bulletin Continues...