Stock Option Trading Strategy – Long calls on energy and heavy equip stocks. Adding mining stocks.

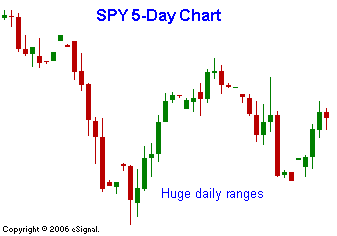

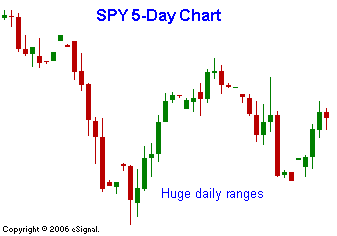

This market is acting very schizophrenic. One minute its up and the next minute its down. If nothing more, the take away is that the upward momentum has stalled and the headwinds are blowing. After last Thursday's decline, we had a big bounce on Friday. The market tried to follow through Monday and it hit resistance. After slipping the whole day, prices were almost unchanged. That set the table for Tuesday morning’s sell off. Once the lows were established the bulls tried to rally prices and the market almost got back to unchanged. However, afternoon selling settled than and the market fell hard yesterday. Today's retail numbers provided some relief and the market made up most of yesterday’s losses. Today's chart pretty much says it all. Volatility has crept into the market and there is two-sided action. I don't believe we will see much of a change the rest of the day. All eyes will be focused on the PPI number due out tomorrow morning. If inflation is contained we will test the highs. If inflation is hot, the SPY 148.5 level will be tested. The market is trying to digest the impact of higher interest rates. During this "discovery period" you should keep your size small. Use this time wisely to find stocks that are holding up while during the declines. Today's market rally is being led by energy and mining stocks. Those are two of my favorite groups and I continue to be long calls.

Daily Bulletin Continues...