Stock Option Trading Strategy – Long energy and heavy machinery stock call options.

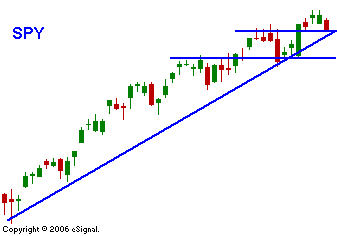

Yesterday I mentioned that I felt the market was just a little too comfortable with the 15% decline in the Shanghai Index over the last few days. The market was able to recover from yesterday's lows and stage a very modest rally. This morning statements from Fed Chairman Bernanke rattled traders. There is a lack of news this week and the market will be searching for anything it can sink its teeth into. This market has a habit of making large 1-day declines and then reversing the sell off. Those large snap back rallies have jettisoned the market to new highs. We are due for a round of profit taking. The bears have been pounded into submission and I do not believe they will test the waters until a major trend line or support level is breached. This is a time to lighten up on your long positions. It is difficult to determine just how far the market will drop before it finds support. The lower it goes, the greater the opportunity on the rebound. I still believe that you must have a "buy the dip" mentality. Don't try to short this market and don't overstay your welcome in long positions. I believe the market will further test the downside this afternoon. I am comfortable holding my long call positions and energy stocks and heavy equipment manufacturers. Those stocks are holding up well. In all likelihood, the market will decline this week and set up for a nice expiration rally next week. If the market breaks below SPY 146, I will exit my long positions and take on a more bearish bias. That is a long way off, but it is a critical support level. That move would represent a failed breakout and many horizontal support levels would be breached. In today's chart you can see that the trend line from March is close to being broken. However, it is so steep that I don’t give it much weight. Again, as long as SPY 146 holds you should be thinking "by the dip".

Daily Bulletin Continues...