Daily Option Trading Strategy

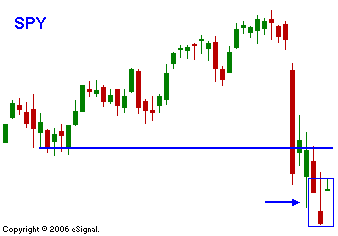

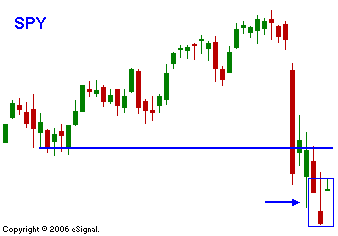

After a strong week and an extended holiday, the market started off on a "soft note". The futures were down in early trading despite lower oil prices. By mid-morning the rally was underway with tech stocks setting the pace. Now that the QQQQs are on the verge of a breakout, the rest of the market has a chance to make a sustained run. I want to see how much momentum the tech stocks can generate without help from the energy sector. I've been mentioning the inverse relationship between oil and tech. Given the reversal this morning we are likely to see a grind higher the rest of the day. The pieces are in place for a nice move. I like selling outs credit spreads on the cyclical stocks with low P/Es that have announced earnings. If you are looking for a couple of long plays, I have posted a QCOM trade. In today's chart you can see the breakout and the upward sloping channel that has formed.

Daily Bulletin Continues...