Stock Option Trading Strategy – Scaling out of long call positions and selling call credit spreads.

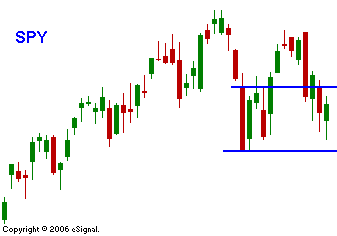

This morning the market tried to do follow through on last week's weak performance. A 3% drop in the Shanghai Index and a weak housing number were enough to generate a 10 point decline and the S&P 500 futures. With than the first 30 minutes, the losses were erased and the market pushed into positive territory. There are a number of economic releases this week, but they will not hold a candle to the comments made by the FOMC. Interest rates are creeping higher domestically and internationally. The Fed has already set the table for its "tight light" bias. The market has previously been able to shrug off that rhetoric, but given the rise in interest rates, this time could be different. We have seen two large down days within a 2 week period and resistance at the all-time highs is mounting. If the Fed keeps its tone, I believe the market will have a negative reaction. A test of the SPY 146 level could materialize. I am not bearish; I simply believe that the market needs to continue its discovery process. It needs to test the buyer’s conviction in a rising interest rate environment. I believe nervous trading and a pullback are soon to come. Last week I took profits on my energy stock call options. I am reducing my mining and heavy equipment call options at this time. I have also added some call credit spreads on retail and restaurant stocks. If the market sells off, my first plan of action is to sell my remaining long call positions. I will do so if the market breaks below the lower blue line in the chart.

Daily Bulletin Continues...