Stock Option Trading Strategy – Trimming bullish positions, adding call credit spreads on retail.

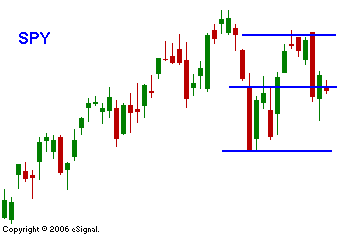

Let me start by saying that I am bullish over the next six-month period. Earnings are strong, valuations are in-line, interest rates are relatively low, employment is high, inflation is in check and global economic growth is strong. On a short-term basis I'm starting to see some warning signs. The market has run up and we have not seen a decent correction in a very long time. In the chart you will notice a few developments. The volatility has increased greatly and it is depicted by the long red-bodied candlesticks. Two recent events tell me that the resistance level at the all-time high is growing strong. The first event happened two weeks ago when we had the gap down after the all-time high was established. That was followed by a very bearish down day. After the market had one of its typical snap back rallies, it was not able to challenge the previous high before it was slapped down. That move came this Wednesday. The market had a positive opened and it made a key reversal. By the close, the S&P 500 futures had lost 20 points. Yesterday's rally was a half-hearted attempt at a rally and it simply shook out short sellers. Once the market was unable to add to Wednesday's decline, the buyers came in for the shakeout. Today the market is off to a weak start. Concerns over the Bear Stearns hedge fund bailout (they invested in sub-prime mortgages) is putting pressure on the market. Interest rates have been creeping higher and a rate hike in China is eminent. Next week will be critical. The FOMC comments will dictate prices for the next month. The Fed has already stated its bias favors an increase. Earlier in the year, traders were wondering when the Fed might ease, now they are wondering how long the Fed will hold off on a rate hike. This will be bearish for the market short-term and I am starting to think that the SPY 146 level will be tested soon. That will ultimately set-up a great buying opportunity. The market needs to get accustom to higher interest rates. Once it does so, all of the other pieces are in place for a continued rally. Given my longer-term bullishness, it will be difficult for me to get short this market. The snap back rallies have been extreme and I don't want to get caught in any of them. I will prepare by reducing my long positions and by selling call credit spreads on stocks that I feel are weak. The retail and restaurant groups are two that I feel will experience selling pressure for the next quarter. If I am wrong, I should be able to adjust by positions and not lose too much money.

Daily Bulletin Continues...