Stock Option Trading Strategy – Reduced long calls in heavy equipment, added call credit spreads.

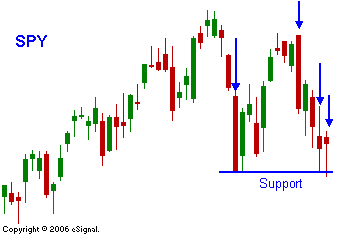

Market volatility has returned. Yesterday, the market staged an early rally and it looked like it would snap back from last week’s losses. Soon after the open, prices reversed and the relative low from Thursday (two weeks ago) was tested. The market was able to find support at that level. Today, the same pattern unfolded as prices opened higher and sellers sold into that early strength. After trying the downside, the market is unchanged and there is a good chance that we will be “dead till the Fed”. The chart has taken on a decidedly bearish look. There have been a number of big down days and negative intraday reversals. That said, I can remember many instances in the last few months were this market looked like it was on its last leg. Out of nowhere a monster snap back rally would change that tone in the course of a day. This is a time to be cautious. The FOMC meeting this week is monumental and the market is likely to have a big reaction. I don’t know which direction it will head. My best course of action is to stay long relative strength and to short relative weakness. Since the market is still in an uptrend I am long calls in heavy equipment and mining stocks. I have taken profits on those positions and my exposure has been reduced by 75%. I have also sold call credit spreads on restaurant and retail stocks. If the market rallies I should have time to buy-in those positions. They are out of the money and those stocks have not been able to rally with the market. Keep your powder dry and line up stocks that are relatively strong and weak. If the market challenges the all-time high, buy strong stocks. If the market closes below SPY 149 it is likely to test 146. If it breaks below SPY 146 – start adding bearish positions.

Daily Bulletin Continues...