Daily Option Trading Strategy

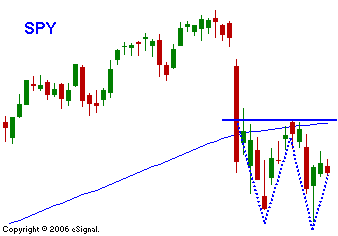

If the big drop was over-extended due to electronic issues or a "surprise" component, we would have seen a bounce by now. The fact of the matter is that fear is the dominant emotion now. Institutional and retail traders are over-extended. Record margin debits and the Yen-Carry trade have become issues. The smart money knows that a nudge in the right direction can force traders to bail. They will make some money on the downside, but more importantly, they will be there to pick up the pieces when everyone is out. Yesterday, the panic was overdone on the open and the strong bid that has been ever present showed itself. Prices snapped back. That move did not allow many people to get out of longs or to short. It happened too quickly. The more concerning move for bulls would be a slow, sustained slide. Personally, I am long puts. I have been stopped out of most of my longs and once the SPY closed below 141 I started getting short. I would like to add on a failed rally, but I don't think I will get the chance. Here's how I see today unfolding. The market is nervous and it will try to suck some people into getting long with a mid-morning rally. The bulls need to step up or the bears will feel confident that they can push prices lower going into the weekend. If the market makes a new daily low in the afternoon, we may close below SPY 139. If the market can get above yesterday's high of SPY 141.20, there is a chance for a meaningful bounce. This is a daily chart of the SPY.

Daily Bulletin Continues...