Daily Option Trading Strategy

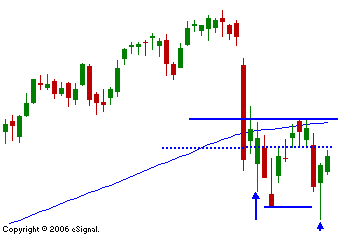

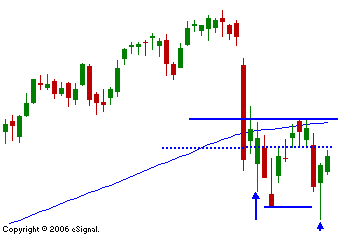

A few days ago the market seemed like it would never go down. Now it is acting very nervous and the people that were looking to buy on a dip (myself included) are going to wait before they dip their toe in the water. That's because the risk is elevated. Investors who were trying to milk the last few percentage points of profit out of their holdings are more anxious to lock in the great 6-month run. Debit margin is high and that creates panic for traders because they are over-extended. The threat of a liquidation by their brokerage firm also looms. I included a 1-hour chart in today's comments. You can see the resistance and the support. SPY 141 represents multiple supprt (trendline, orizontal, 100-day MA). A close below it is negative. Today is critical. A close above 142 would get everyone breathing easy again. A close below 139 would be negative. My suspicion is that the decline was over done on the open. The speculators who rushed in to get short got squeezed out. The better move will come off of the rally. A steady drift lower would not be good and it could pick up steam. The nervousness was there from the open and it is still there. After the intial rally, the momentum has stalled. Use these levels to guide you.

Daily Bulletin Continues...